Quick Summary

We explore what weekly payroll is, its benefits for employers and employees, and the challenges it presents. You will also learn some practical steps and best practices for managing weekly payroll efficiently, with insights on how our platform, Checkwriters, can streamline the process. Unlock actionable strategies in our blog to optimize your payroll system.

Looking to Start Running Weekly Payrolls?

In February 2023, 27% of U.S. private establishments used weekly payroll, making it the second most common pay period after biweekly payroll at 43%.

This goes to show the crucial role weekly payrolls play, which you might be unaware of. In this Checkwriters guide, we’ll explore the ins and outs of weekly payroll and beyond. But first…

Why Listen to Us?

At Checkwriters, we offer an all-in-one payroll and HR platform with features like automated payroll processing, applicant tracking, and onboarding. Our customer-centric approach ensures dedicated support and seamless integration, enhancing efficiency and compliance.

Clients, including the YMCA of Pawtucket and Berwick Academy, have managed to improve payroll accuracy and reduced processing costs by up to 50% using our services.

What Is Weekly Payroll?

Weekly payroll is a payment system where employees receive their wages once every week. This schedule ensures timely compensation for hourly workers or industries with frequent shifts, maintaining employee satisfaction and financial consistency.

Weekly payroll involves several crucial components:

- Time Tracking: Accurate recording of employee hours, often using digital tools.

- Calculations: Computing gross pay, taxes, and deductions weekly.

- Compliance: Ensuring adherence to labor laws and tax regulations.

- Processing: Issuing payments through checks, direct deposit, or other methods.

Weekly payroll is common in industries requiring flexibility and prompt payment, including:

- Construction: Workers are often paid weekly based on completed tasks or hours.

- Retail: Seasonal and part-time employees benefit from quick pay cycles.

- Hospitality: Roles with variable hours, like servers and bartenders, require frequent payment.

- Staffing Agencies: Temporary employees are paid weekly for short-term assignments.

Weekly Payroll Vs. Biweekly Payroll

| Weekly payroll | Biweekly payroll | |

| Frequency | Pays employees 52 times a year | Pays employees 26 times a year |

| Administrative effort | Requires more frequent calculations and processing | Requires less frequent calculations and processing |

| Cash flow | Requires consistent cash availability | Provides more time between payments |

Benefits of Weekly Payroll

For Employers

Enhanced Financial Management

Weekly payroll provides employers with a structured, predictable pay schedule that aids in managing short-term cash flow effectively. This frequent cycle allows organizations to align payroll outflows with incoming revenue streams, reducing financial strain and improving operational stability.

- Improved Cash Forecasting: Weekly payroll offers regular expense patterns, enabling precise budgeting and expense tracking.

- Reduced Financial Surprises: Frequent payroll processing minimizes errors and ensures faster correction of discrepancies, maintaining financial accuracy.

Easier Compliance

Weekly payroll simplifies legal and tax compliance by providing more frequent opportunities to process accurate overtime, deductions, and tax withholdings. Regularly updated calculations reduce the risk of errors that can lead to penalties or strained employee relations.

By processing payroll weekly:

- Employers can quickly adapt to changing labor laws and ensure accurate adherence to wage regulations.

- Audits and records remain current, streamlining reporting requirements for regulatory bodies.

This proactive approach to compliance minimizes liability and builds trust with employees and stakeholders.

Attraction and Retention of Talent

Weekly payroll appeals to workers who value frequent access to earnings, particularly in industries reliant on hourly or variable schedules. This pay structure can improve job satisfaction, reduce turnover, and position employers as competitive and employee-focused.

- Improved Recruitment: Weekly pay draws candidates seeking financial stability, enhancing your hiring pool.

- Reduced Turnover: Consistent pay schedules encourage loyalty, saving costs associated with rehiring and training.

For Employees

Faster Access to Wages

Weekly payroll gives employees quicker access to their earnings, providing financial flexibility for immediate needs. This frequent pay schedule reduces reliance on high-interest credit options and supports financial stability for workers managing day-to-day expenses.

- Financial Relief: Timely pay allows employees to handle unexpected costs, like medical bills or car repairs.

- Reduced Stress: Frequent income boosts confidence in meeting regular expenses, fostering workplace satisfaction.

Simpler Budgeting

Weekly payroll simplifies financial planning by aligning paychecks with short-term expenses. Employees can better manage recurring costs, like groceries and utilities, with consistent income that supports incremental budgeting rather than relying on large, biweekly sums.

By receiving regular pay:

- Workers can track and allocate funds for immediate needs, minimizing overspending.

- Shorter intervals between paydays reduce the risk of running out of money before the next check.

This structure empowers employees to maintain financial control and reduce the stress of long-term budget gaps.

Increased Transparency

Weekly payroll enhances financial visibility by providing employees with frequent updates on earnings, hours worked, and deductions. This consistent flow of information encourages trust and empowers employees to better understand and manage their finances.

- Regular Feedback: Weekly pay stubs allow employees to promptly identify and address discrepancies.

- Improved Financial Awareness: Frequent paychecks make tracking earnings and planning for expenses more intuitive.

By offering consistent insights into pay details, employers create an environment of clarity and accountability, benefiting both the workforce and overall workplace trust.

Challenges of Weekly Payroll

Increased Administrative Workload

Weekly payroll creates a more demanding schedule for HR and payroll teams, requiring precise calculations and timely processing. The frequency increases the risk of errors and demands additional resources to maintain accuracy.

Key administrative challenges include:

- Time Constraints: Processing payroll weekly leaves little room for corrections or delays.

- Manual Intervention: Frequent adjustments to hours, overtime, and deductions strain team capacity.

To address this, your organization can invest in robust automation tools such as Checkwriters, or outsource payroll management, to ensure operational efficiency without overwhelming staff.

Higher Costs

Processing payroll on a weekly schedule can significantly increase operating expenses for organizations. The additional frequency drives up costs associated with payroll software, bank transaction fees, and compliance-related adjustments.

Specific cost impacts include:

- Software Fees: Many payroll systems charge per payroll run, multiplying costs.

- Banking Charges: Weekly direct deposit transactions add recurring expenses.

You should carefully evaluate these costs against the benefits of weekly payroll, ensuring that the added frequency justifies the investment and aligns with your financial priorities.

Cash Flow Management

Weekly payroll requires organizations to maintain consistent cash availability, challenging those with fluctuating revenue streams. Balancing payroll demands with other operational expenses can create financial pressure, especially for small or seasonal organizations.

Strategies to manage cash flow effectively include:

- Revenue Forecasting: Align income predictions with payroll schedules to ensure liquidity.

- Contingency Planning: Establish reserves or credit options for periods of reduced income.

Proactive planning helps mitigate financial stress while supporting the consistency required for weekly payroll operations.

How Weekly Payroll Works

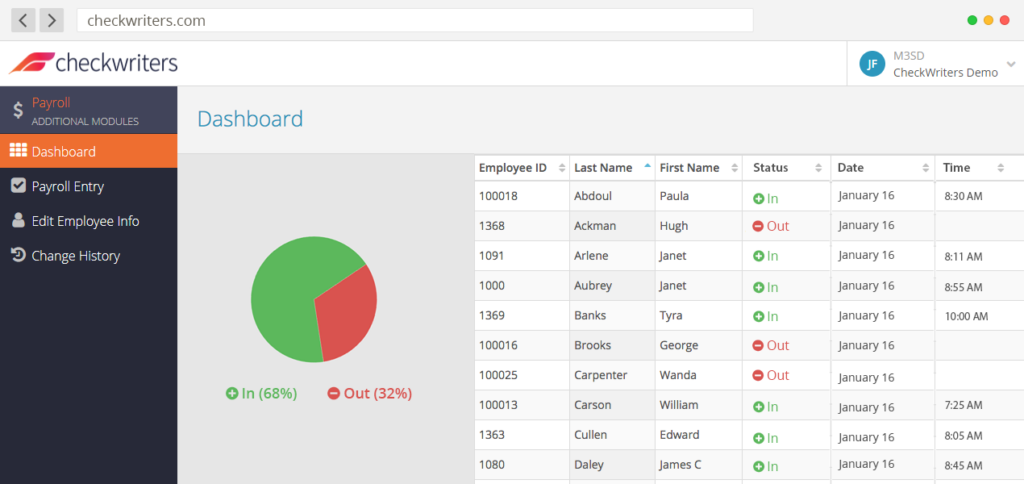

1. Time Tracking and Data Collection

Employers must collect precise records of hours worked, including regular shifts, overtime, and breaks. This step ensures compliance with wage laws and prevents payroll errors.

Key approaches to time tracking include:

- Digital Time Clocks: Use systems that integrate directly with payroll platforms for seamless data transfer.

- Mobile Solutions: Enable remote workers to clock in/out via apps, ensuring accurate tracking for all staff.

For instance, let’s say, a small retail store named “Fresh Finds Market” implements weekly payroll for its 15 employees, who work variable hours and shifts.

It uses a digital time clock system integrated with its payroll software. Employees clock in and out using a mobile app that syncs data in real-time. For instance, cashier Sarah works 32 hours this week, which the system logs automatically, reducing manual data entry errors.

Our attendance system simplifies data collection, reducing administrative burdens and enhancing accuracy by integrating directly into the payroll process.

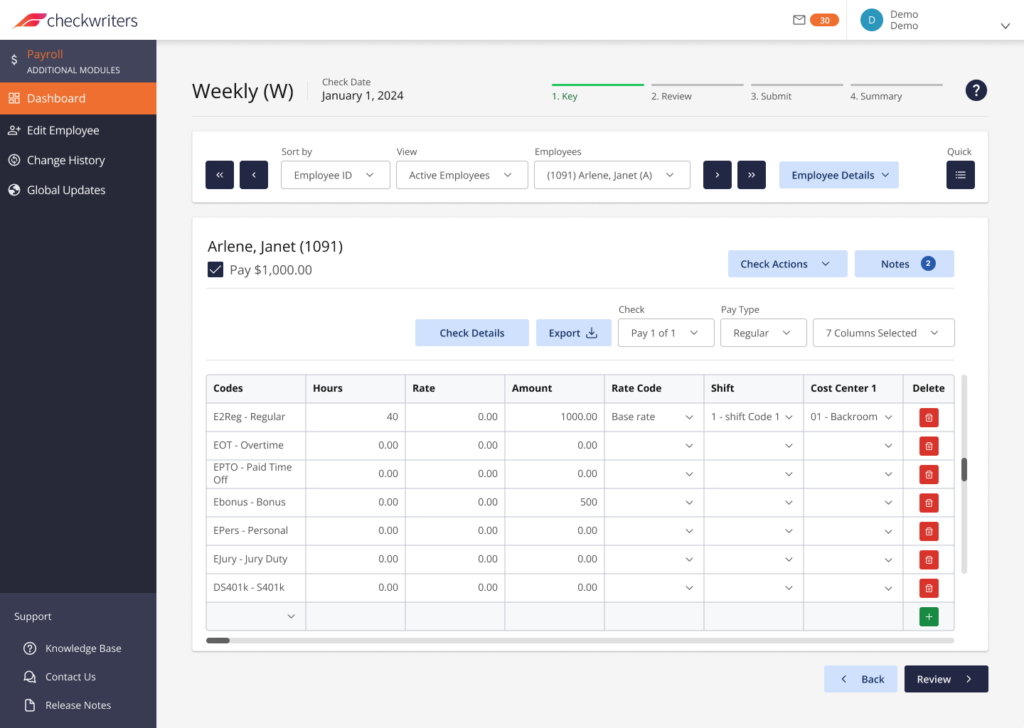

2. Payroll Calculations

Weekly payroll requires precise calculations to determine employee compensation accurately. This includes gross pay, deductions, taxes, and net pay. Ensuring accuracy at this stage minimizes errors, maintains compliance, and improves employee trust in payroll processes.

Take in these factors for payroll calculations:

- Taxes and Deductions: Account for federal, state, and local taxes, as well as employee benefits.

- Overtime Pay: Ensure accurate calculation of hours exceeding regular schedules.

- Adjustments: Handle corrections for missed punches or time-off deductions.

Considering the previous scenario, the payroll system calculates Sarah’s gross pay for her 32 hours, adds overtime pay for 2 extra hours worked on Friday, and deducts taxes and benefits.

Our payroll platform automates these tasks, managing compliance with tax laws and consistent, error-free calculations. Automation enhances efficiency and reduces manual workload.

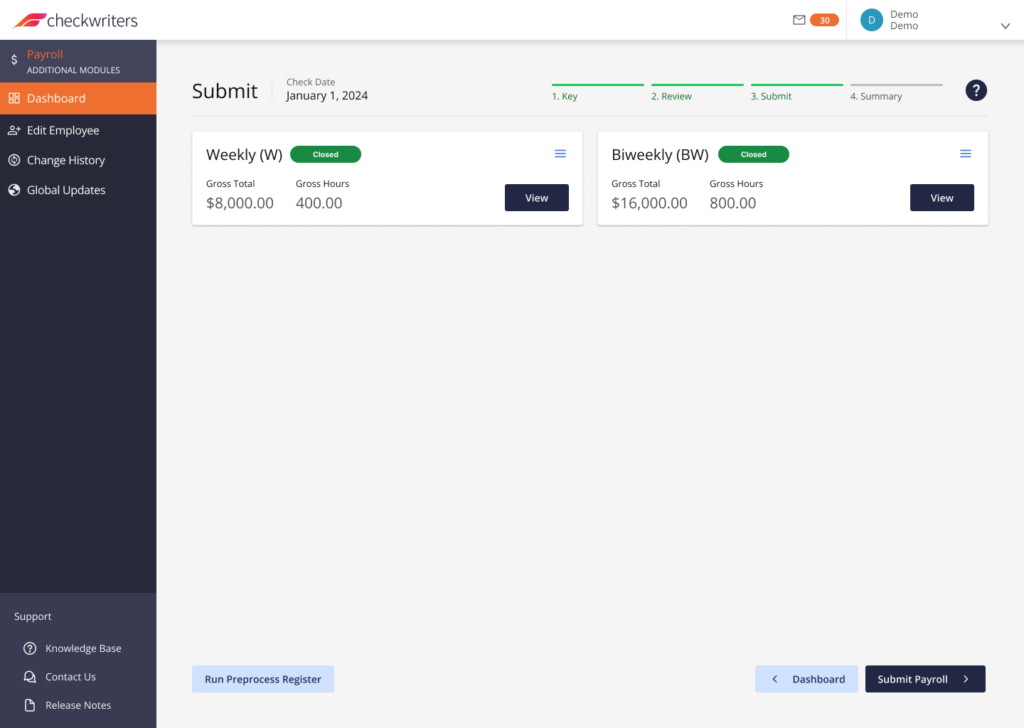

3. Payment Processing

Employers must ensure all employees receive their net pay through preferred methods, such as direct deposit, paper checks, or payroll cards, while adhering to legal payment deadlines.

Efficient payment options include:

- Direct Deposit: Secure, automated transfers reduce processing time and errors.

- Payroll Cards: Provide unbanked employees with easy access to funds.

Let’s say by the end of the week, the retail store’s payroll manager approves the finalized payroll. Sarah’s net pay is processed via direct deposit, and her pay stub is available through the same mobile app. Other employees choose between direct deposit or receiving checks, all managed seamlessly within the same platform.

We simplify payment processing by offering flexible options that integrate seamlessly into payroll systems, ensuring accuracy and timeliness for every pay cycle.

Best Practices for Weekly Payroll

- Audit Time Entries Regularly: Review weekly time entries to ensure accuracy and detect anomalies, such as missed punches or unauthorized overtime, to prevent recurring payroll errors.

- Automate Tax Compliance: Leverage payroll systems to handle tax deductions, filings, and updates automatically, ensuring adherence to changing regulations with minimal manual intervention.

- Establish Payment Deadlines: Set internal deadlines for submitting hours and approvals, allowing ample time to process and issue accurate payments each week.

- Use Secure Payroll Tools: Select platforms with robust security features to safeguard sensitive employee data, ensuring compliance with privacy standards.

- Communicate Payroll Policies Clearly: Provide employees with concise guidelines on reporting hours, resolving disputes, and understanding deductions to streamline payroll process.

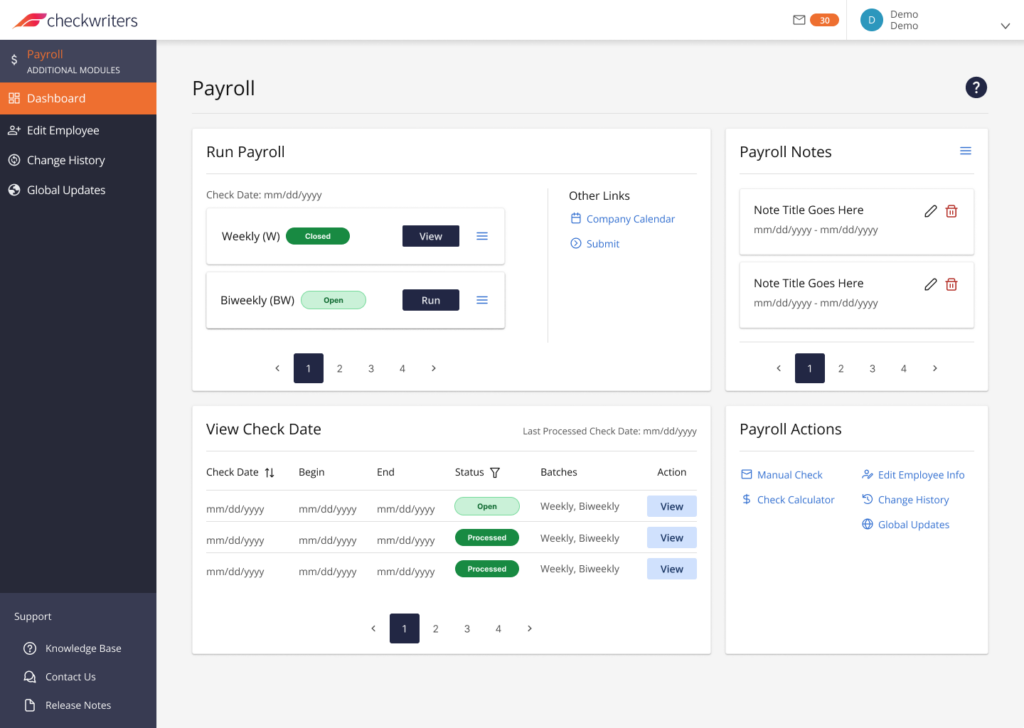

Streamline Your Weekly Payroll with Checkwriters

Weekly payroll ensures timely and accurate employee compensation but requires careful management to balance efficiency, compliance, and costs. By leveraging the right tools, your organization can streamline this process and reduce administrative burdens.

At Checkwriters, our all-in-one payroll and HR platform automates time tracking, payroll calculations, and payment processing. With robust compliance features and flexible payment options, we empower organizations to manage weekly payroll with confidence and ease.Ready to simplify your weekly payroll process? Contact Checkwriters today!