Quick Summary

Payroll reports are essential for compliance, financial planning, and workforce management, but not all reports offer the same level of insight and automation. This guide explores the most critical types of payroll reports—like tax liability, benefits deductions, and payroll cost analysis—and showcases the best tools for generating them. Don’t forget to check our blog and podcasts to dive deeper into payroll management.

Struggling to Create an Accurate Payroll Report?

Over half (53%) of companies have incurred payroll penalties in the last five years due to non-compliance. This underscores the importance of precise payroll reporting to avoid financial and legal repercussions.

In this Checkwriters guide, we’ll walk you through 8 types of payroll reports along with tools for creating them. But first…

Why Listen to Us?

At Checkwriters, we streamline payroll reporting with automated calculations, real-time previews, and compliance tools. Our reports provide clear insights into labor costs, tax liabilities, and benefits, reducing manual work and errors.

For instance, Berkshire Hills Music Academy has enhanced its operations by using our custom reporting and analytics tools. By implementing our tailored solutions, the Academy has improved its data management and operational efficiency, allowing staff to dedicate more time to student development.

What Are Payroll Reports?

Payroll reports track payroll trends, helping organizations optimize staffing and budgeting. They also flag discrepancies, such as overtime inconsistencies or benefits misallocations, before they become costly issues.

Payroll reports provide detailed insights into:

- Labor costs

- Tax liabilities

- Compliance metrics

- Financial planning

- Cash flow management

…and more. Without them, organizations risk inefficiencies, miscalculations, and potential legal penalties.

Advanced payroll reports can often integrate with HR and accounting systems, ensuring real-time accuracy. This way, you can support strategic decision-making by identifying cost-saving opportunities and forecasting workforce expenses.

Why Are Payroll Reports Important?

- Regulatory Compliance – Verify proper withholdings, tax filings, and adherence to employment regulations.

- Financial Planning – Track labor costs, benefits, and deductions, allowing organizations to manage budgets, forecast expenses, and optimize cash flow.

- Error Detection – Help catch and correct errors caused by discrepancies that could lead to overpayments, underpayments, or compliance risks.

- Audit Preparedness – Provide clear records for internal audits and external compliance checks.

- Workforce Insights – Organizations can analyze payroll data to assess overtime trends, employee compensation, and staffing efficiency.

8 Best Payroll Reports with Examples

- Payroll Compliance Reports – Checkwriters

- Tax Liability Reports – Patriot Software

- Benefits Deduction Reports – Square Payroll

- Time and Attendance Reports – Workday Payroll

- Compliance and Audit Reports – SurePayroll

- Payroll Cost Analysis Reports – Justworks Payroll

- General Ledger Payroll Reports – QuickBooks Payroll

- Historical Payroll Summaries – Sage Payroll

1. Payroll Compliance Reports

Payroll compliance reports ensure organizations adhere to federal, state, and industry-specific needs and regulations. They can also help with documentation for tax authorities, auditors, and internal HR teams, reducing the risk of penalties and legal disputes.

A strong payroll compliance report should:

- Track multi-jurisdiction tax compliance – Get accurate tax reporting across different states, considering local withholding rules and unemployment tax rates.

- Monitor wage and hour adherence – Assists with compliance with minimum wage, overtime rules, and exempt vs. non-exempt employee classifications.

- Document benefits eligibility – Helps with Affordable Care Act (ACA) and Family and Medical Leave Act (FMLA) requirements for employee benefits.

- Provide audit-ready payroll summaries – Generates detailed payroll breakdowns to support reviews, audits, and more.

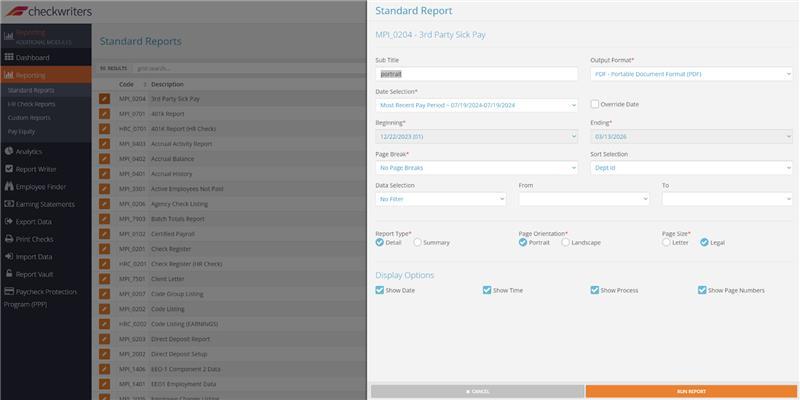

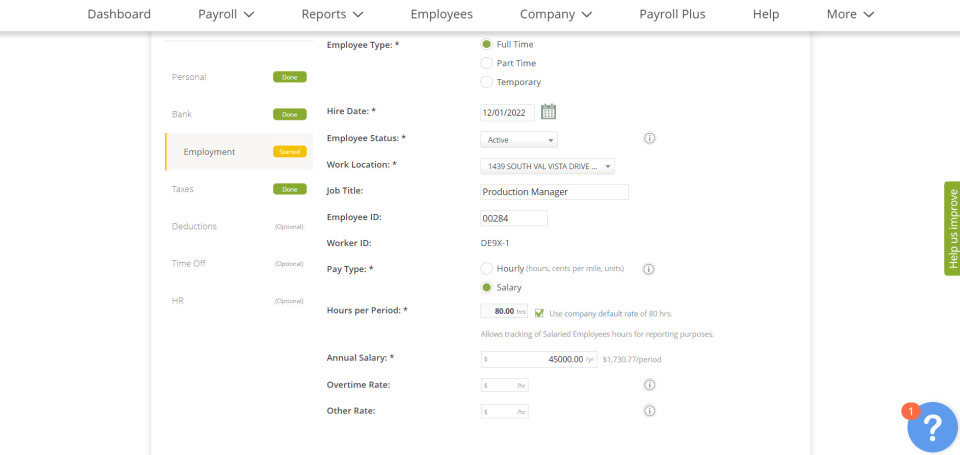

Example: Checkwriters

At Checkwriters, we automate key components of payroll compliance with real-time data and customizable reporting. Key features include:

- Real-time error detection – Flags potential compliance risks before payroll is processed.

- Custom legal compliance reports – Generates workforce summaries for ACA, EEOC, and labor law reporting.

For organizations navigating complex payroll regulations, our compliance reports provide transparency, accuracy, and proactive risk management.

2. Tax Liability Reports

Tax liability reports break down employer and employee tax obligations, ensuring accurate withholdings and compliance with federal, state, and local regulations. They’re critical for cash flow planning, avoiding penalties, and maintaining audit readiness.

A well-structured tax liability report should:

- Categorize tax obligations – Clearly separate employer-paid taxes (FICA, FUTA, SUTA) from employee withholdings (income tax, Social Security, Medicare) to prevent misallocations.

- Highlight upcoming tax deadlines – Provide real-time insights into due dates and estimated payments to avoid late fees.

- Detect discrepancies – Flag inconsistencies between payroll tax withholdings and actual filings, reducing the risk of compliance violations.

- Integrate with financial planning – Align tax liabilities with broader budget forecasts to prevent cash flow disruptions.

A well-structured tax liability report ensures accurate withholdings and timely filings, reducing discrepancies that could complicate the business’s tax return.

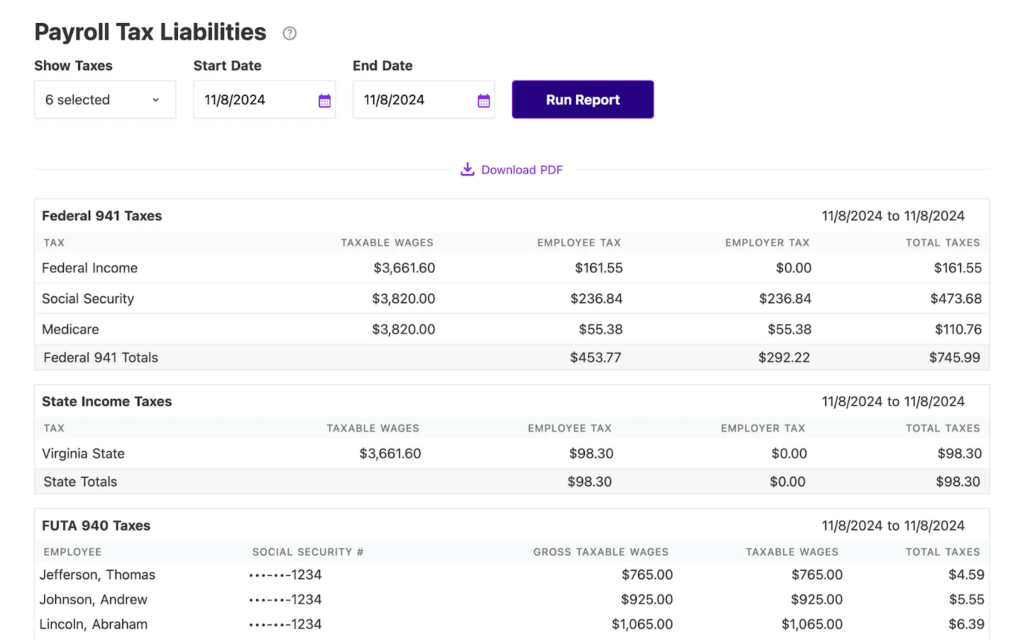

Example: Patriot Software

Patriot Software offers a robust Payroll Tax Liabilities Report that aids businesses in calculating their payroll tax liabilities and preparing for tax filings. Key features include:

- Comprehensive tax summaries – Provides totals for all wages and taxes within a specified period, assisting in accurate tax deposit calculations.

- Customizable reporting – Allows selection of specific tax types and date ranges to generate tailored reports.

- User-friendly interface – Simplifies the process of tracking and managing payroll tax obligations.

For businesses seeking to manage their payroll tax responsibilities effectively, Patriot Software’s Payroll Tax Liabilities Report offers a reliable and user-friendly solution.

3. Benefits Deduction Reports

Benefits deduction reports provide a clear, itemized breakdown of employee contributions to health insurance, retirement plans, and other pre-tax or post-tax benefits. These reports ensure accurate payroll deductions, prevent compliance issues, and help businesses manage total compensation costs effectively.

- Track employer and employee contributions separately – Distinguishing between company-paid and employee-paid portions ensures accurate financial planning.

- Identify pre-tax vs. post-tax deductions – Helps businesses maximize tax benefits while maintaining compliance with IRS regulations.

- Detect under- or over-deductions – Flags miscalculations that could result in payroll errors, benefits lapses, or compliance violations.

- Provide reconciliation insights – Aligns deductions with benefits provider invoices to prevent discrepancies.

A high-value benefits deduction report should provide a monthly breakdown of pre-tax and post-tax contributions, ensuring accuracy and compliance.

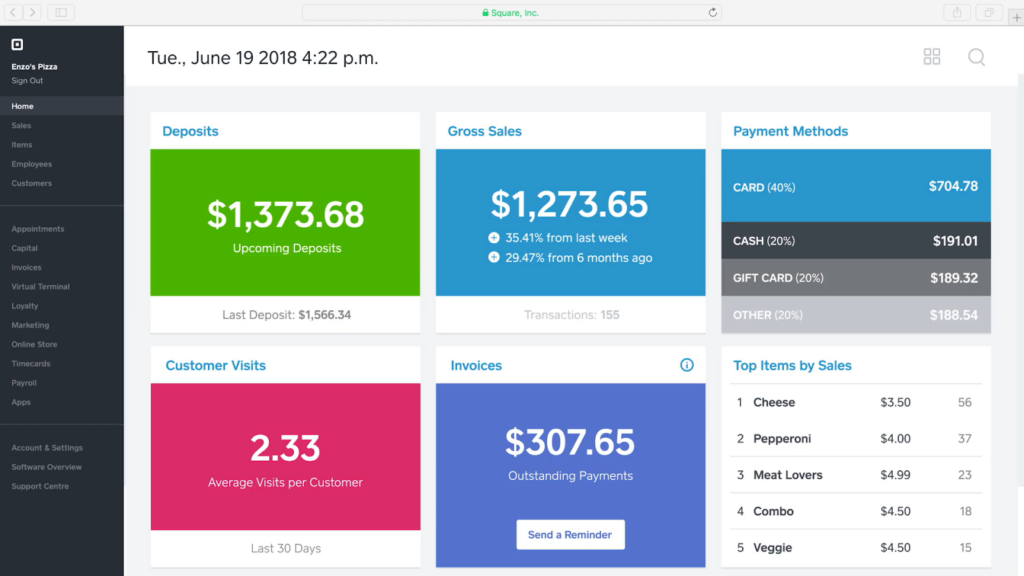

Example: Square Payroll

Square Payroll simplifies benefits deductions by integrating directly with benefits providers and automating calculations. Key features include:

- Seamless benefits syncing – Automatically adjusts deductions based on enrollment changes.

- Real-time payroll previews – Ensures deductions are applied correctly before payroll runs.

- Year-end compliance reporting – Generates ACA compliance reports and W-2 summaries with benefits details.

For businesses offering competitive benefits packages, Square Payroll’s automated deduction reports eliminate errors and streamline compliance.

4. Time and Attendance Reports

Time and attendance reports document employee time worked, overtime, and paid leave, ensuring payroll accuracy and compliance with labor laws. These reports are critical for managing workforce costs, preventing payroll fraud, and maintaining regulatory compliance under FLSA, ACA, and state labor laws.

A robust time and attendance report should:

- Break down regular, overtime, and unpaid hours – Categorizing time ensures proper wage calculations and compliance with overtime laws.

- Track paid and unpaid leave balances – Aligns PTO, sick leave, and FMLA tracking with payroll to prevent discrepancies.

- Monitor overtime trends – Identifies excessive labor costs or potential compliance risks with state and federal overtime rules.

- Detect timekeeping inconsistencies – Flags missed punches, unauthorized time edits, and potential buddy-punching fraud.

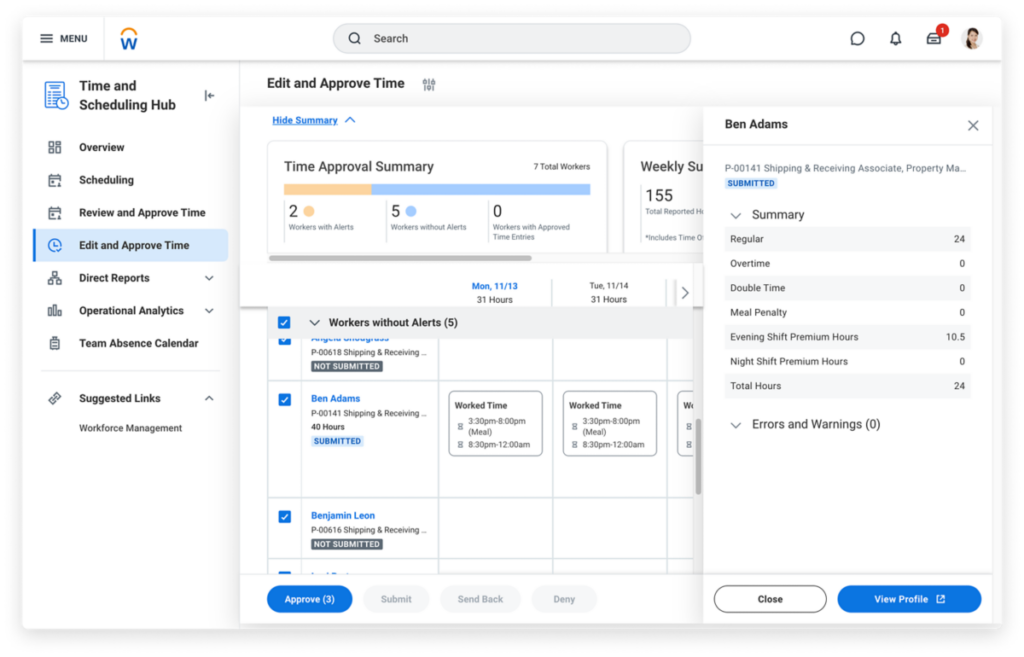

Example: Workday Payroll

Workday Payroll integrates with time-tracking systems to provide real-time labor data, improving payroll accuracy and workforce planning. Key features include:

- Automated overtime calculations – Applies complex rules based on local labor laws and company policies.

- Geolocation-based time tracking – Prevents unauthorized clock-ins from remote locations.

- Predictive labor analytics – Uses AI-driven insights to optimize scheduling and labor allocation.

For organizations with complex scheduling needs, Workday Payroll’s time and attendance reports provide data-driven insights that reduce compliance risks and optimize workforce costs.

5. Compliance and Audit Reports

Compliance and audit reports ensure that payroll practices align with federal, state, and local labor laws. These reports are essential for avoiding legal penalties, managing risk, and maintaining transparency in financial reporting.

A strong compliance and audit report should:

- Verify tax filings and payments – Confirms that payroll taxes are correctly withheld, reported, and remitted on time.

- Track wage law adherence – Ensures compliance with minimum wage, overtime, and exempt employee classification rules.

- Identify payroll discrepancies – Flags irregularities such as duplicate payments, missing deductions, or misclassified employees.

- Provide documentation for audits – Creates a clear audit trail for government agencies and internal reviews.

Example: SurePayroll

SurePayroll automates compliance tracking and provides audit-ready reports tailored to regulatory requirements. Key features include:

- Automated tax compliance checks – Identifies errors before payroll is processed.

- Historical payroll audits – Generates reports to assist with tax filings and labor audits.

- Real-time compliance alerts – Notifies HR teams of potential risks, such as classification errors or wage violations.

SurePayroll enables businesses to access a wide range of compliance reports, ensuring that payroll tax filings, wage calculations, and employee classifications align with legal standards

6. Payroll Cost Analysis Reports

Payroll cost analysis reports break down total labor expenses, helping businesses optimize workforce budgets, control overhead, and improve profitability. These reports go beyond simple wage tracking—they provide strategic insights into cost efficiency and workforce planning.

A high-value payroll cost analysis report should:

- Categorize direct vs. indirect labor costs – Distinguishes salaries, overtime, and contractor payments from benefits, payroll taxes, and compliance fees.

- Highlight cost trends – Identifies monthly and seasonal labor fluctuations, rising overtime expenses, and workforce inefficiencies.

- Compare departmental payroll spending – Helps finance teams assess budget alignment and cost allocation across business units.

- Model cost-saving scenarios – Simulates how workforce changes (e.g., hiring, layoffs, benefits adjustments) impact financial projections.

A well-structured payroll cost analysis report should allow finance teams to run queries on workforce spending by department, time period, or job classification.

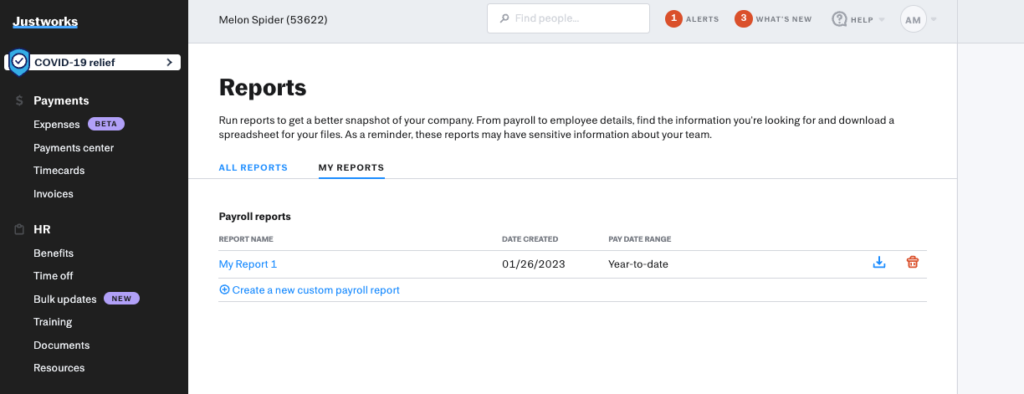

Example: Justworks Payroll

Justworks Payroll provides automated cost breakdowns and trend analysis to help businesses make data-driven decisions. Key features include:

- Real-time labor cost tracking – Monitors expenses across departments, locations, and employment types.

- Automated budget forecasting – Uses payroll data to project future costs and optimize hiring strategies.

- Benchmarking tools – Compares payroll expenses against industry standards for better decision-making.

Justworks Payroll provides automated cost breakdowns and trend analysis by processing extracts from your company’s payroll system, ensuring real-time accuracy and financial clarity.

7. General Ledger Payroll Reports

General ledger (GL) payroll reports categorize payroll transactions, aligning labor costs with financial statements. These reports ensure accurate bookkeeping, simplify tax preparation, and support financial audits by mapping payroll expenses to specific accounts.

A well-structured GL payroll report should:

- Classify payroll expenses by category – Breaks down wages, taxes, and benefits into specific ledger accounts for financial tracking.

- Ensure accurate reconciliations – Matches payroll records with bank statements to prevent discrepancies.

- Support tax compliance – Identifies taxable wages and employer tax liabilities to streamline reporting.

- Enhance cost allocation – Segments payroll costs by department, location, or job role to support financial analysis.

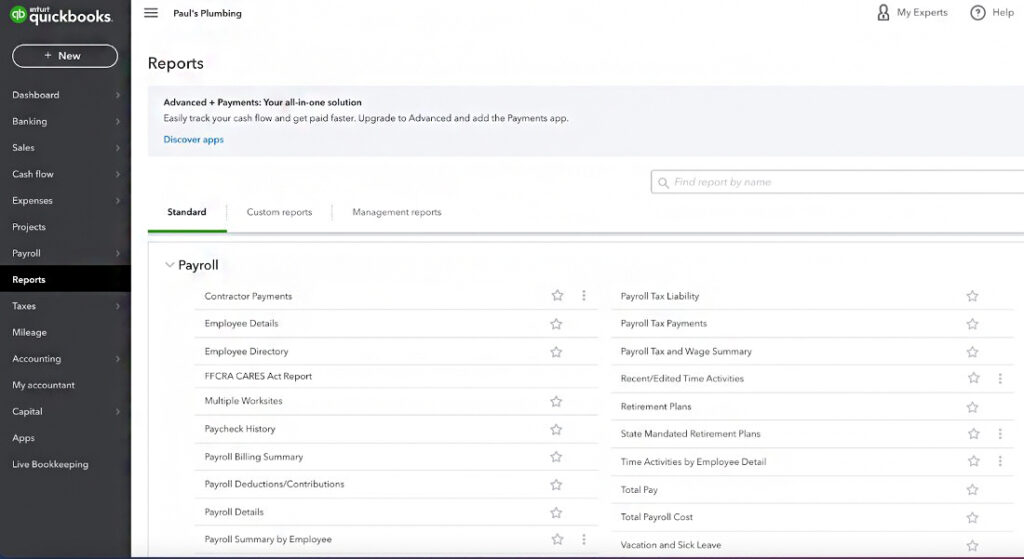

Example: QuickBooks

QuickBooks Payroll integrates payroll data directly into accounting software, reducing manual entry and errors. Key features include:

- Automated payroll-to-ledger mapping – Ensures payroll expenses flow into the correct accounts in real-time.

- Bank reconciliation tools – Matches payroll transactions with bank records for accuracy.

- Custom financial reports – Generates detailed cost breakdowns for budgeting and forecasting.

For businesses seeking seamless payroll accounting, QuickBooks Payroll’s GL reports provide structured, audit-ready financial data to improve bookkeeping accuracy and compliance.

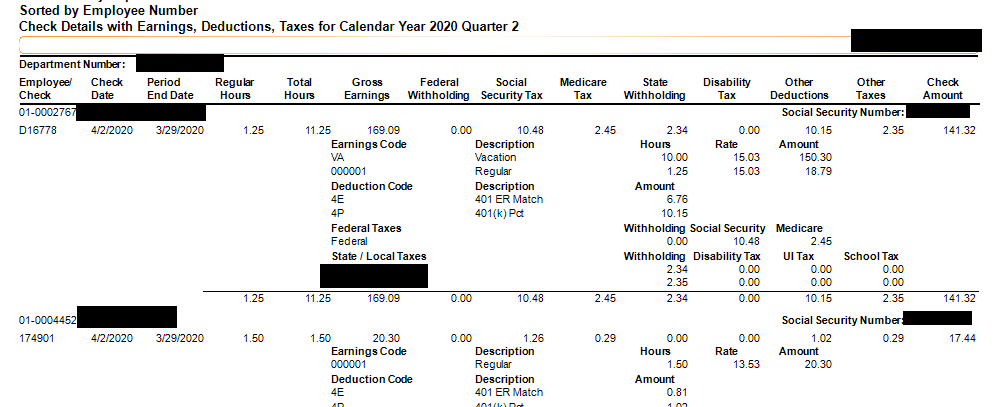

8. Historical Payroll Summaries

Historical payroll summaries consolidate past payroll data, providing long-term insights into wage trends, tax filings, and benefits distributions. These reports are critical for financial audits, budget forecasting, and workforce cost analysis.

A high-value historical payroll summary should:

- Aggregate multi-year payroll data – Helps businesses analyze compensation trends and adjust budgeting strategies.

- Support compliance audits – Ensures accurate historical tax records and employee payment histories for legal and regulatory reviews.

- Compare workforce costs over time – Identifies labor cost fluctuations due to hiring, turnover, or policy changes.

- Assist in tax planning and corrections – Helps resolve discrepancies in prior payroll filings to avoid penalties.

Historical payroll summaries should include advanced search and query functions, making it easy to retrieve specific pay periods for audits and forecasting.

Example: Sage Payroll

Sage Payroll offers comprehensive historical payroll tracking with automated data retrieval and customizable reporting. Key features include:

- Multi-year payroll data archiving – Provides quick access to past records for audits and compliance checks.

- Trend analysis and forecasting – Uses historical insights to project future labor costs and optimize workforce planning.

- Custom export options – Integrates past payroll data with accounting and tax software for streamlined reporting.

For organizations requiring long-term payroll insights, Sage Payroll’s historical summaries provide a structured, compliance-ready approach to payroll data management.

Streamline Payroll Reporting with Checkwriters

The right payroll reporting tools provide accuracy, automation, and insights that help organizations stay ahead. For a seamless, compliant payroll experience, businesses need solutions that go beyond basic reporting.

At Checkwriters, we simplify payroll reporting with automated tax compliance, real-time analytics, and customizable reporting features. Designed for accuracy and efficiency, our platform helps organizations manage payroll complexities while staying compliant with evolving regulations.

Power your payroll with precision—request a demo at Checkwriters today!

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.