Quick Summary

Payroll fraud can lead to significant financial losses, but with the right detection and prevention strategies, organizations can protect themselves. This guide covers common types of payroll fraud, how to spot it, and best practices to prevent it. Stay proactive with regular audits, automated systems, and strong internal controls. For more insights, explore our blog and podcast for additional resources.

Understanding the Hidden Threat of Payroll Fraud and How to Protect Your Organization

Payroll fraud affects 27% of all organizations. That means about one in four organizations will face this type of theft during their operations. It’s a pervasive issue that can lead to serious financial losses, leaving many leaders unaware until the damage is done. If you believe your organization is immune, think again. Payroll fraud can occur in any organization and may be more difficult to spot than you realize.

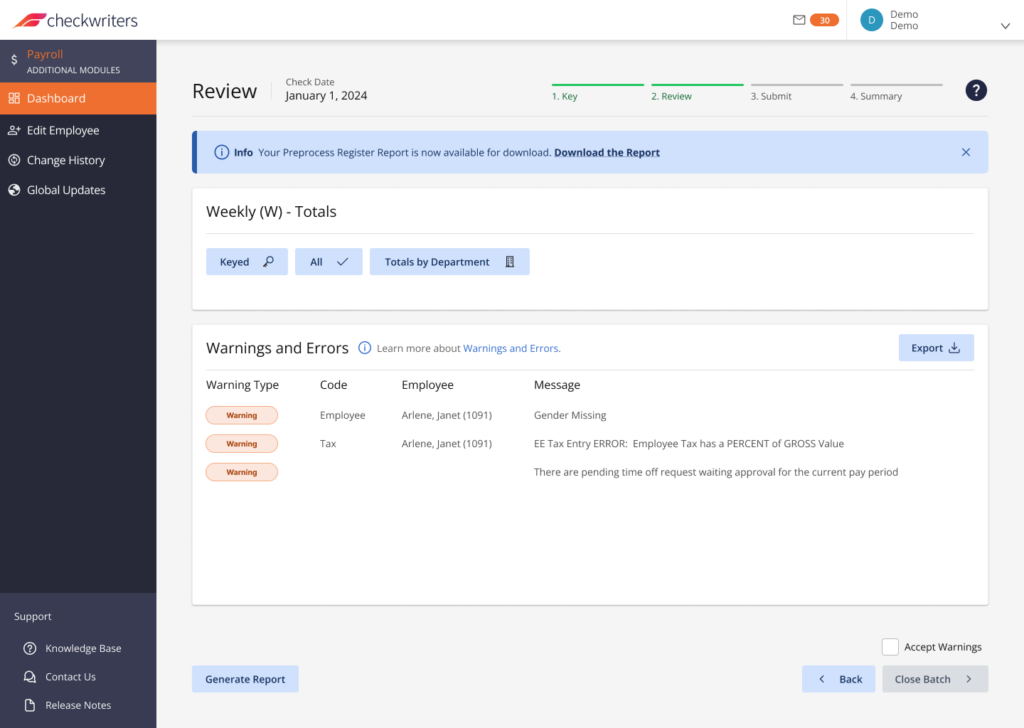

Checkwriters play an important role in safeguarding your organization from this risk. In this article, we will help you recognize the signs of payroll fraud, detect discrepancies, and implement preventive measures, which are essential steps every organization must take to safeguard its finances.

Why Listen to Us?

At Checkwriters, we prioritize your success by providing tailored payroll and HR solutions that adapt to the specific needs of your business.

From Heritage Preparatory School, which streamlined payroll and HR management to focus on educational excellence, to Katz Hillel Day School, which integrated payroll and HR for greater efficiency, our clients are able to simplify complex payroll processes.

Our clients reclaim valuable time to focus on their core missions. They reduce administrative burdens, achieve greater payroll accuracy, and streamline operations, all of which drive their ongoing success and growth.

What Is Payroll Fraud?

Payroll fraud happens when individuals intentionally manipulate payroll systems for financial gain. It can involve both employees and managers or external parties who exploit payroll processes. With the right tools and oversight, many organizations are able to detect and prevent fraud before it causes significant harm.

There are several types of payroll fraud, and they can manifest in many ways. But no matter the method, the goal of payroll fraud is always to receive more money than one is entitled to.

Types of Payroll Fraud

- Ghost Employees: Ghost employees are fabricated workers added to the payroll system. The person committing the fraud collects payments meant for these non-existent employees.

Example: A payroll manager added a fake employee and collected paychecks for over a year before a routine audit revealed the worker had never existed. - Falsified Hours:Employees may submit fraudulent work hours, including overtime they didn’t work.

Example: A restaurant manager discovered a server was submitting overtime hours that didn’t match their actual shifts, resulting in over $5,000 in unauthorized pay. - Payroll Padding: Employees may inflate their salary or bonuses by including incorrect figures or submitting fake expense claims.

Example: An accountant padded their paycheck by submitting fake travel receipts and unauthorized bonuses, inflating their earnings for six months before it was uncovered. - Misclassifying Employees: Employees might be misclassified as independent contractors or overtime-exempt, allowing them to receive more pay than they should.

Example: A company misclassified some workers as exempt from overtime pay, leading to higher salaries than warranted by their actual roles. - Fake Deductions or Benefits: Fraudulent deductions or fake benefits can be created by manipulating payroll records. This might include altering tax deductions or making unauthorized payments to benefit providers.

Example: A payroll specialist manipulated benefits enrollment to funnel extra funds into their personal account, resulting in substantial financial loss for the company.

How to Detect Payroll Fraud

Detecting payroll fraud can be tricky, but with the right tools and processes in place, your organization can identify discrepancies early. Here’s how to spot it:

Step 1: Monitor for Unexplained Adjustments

Check for pay adjustments that lack clear documentation or cannot be justified. These could include sudden changes in pay rates, bonuses, or overtime that don’t align with actual hours worked or employee performance.

Any adjustments should have supporting documentation and approval, so it’s important to investigate any discrepancies that don’t match company policies or job performance.

Step 2: Look for Patterns of Inflated Hours or Unauthorized Overtime

Compare timesheets and pay records. Are there employees consistently reporting more overtime than usual? Are some employees getting paid for hours they didn’t work? Spotting patterns like these can indicate fraud, such as employees inflating their time or submitting fraudulent overtime claims.

Step 3: Cross-check Payroll with Time and Attendance Records

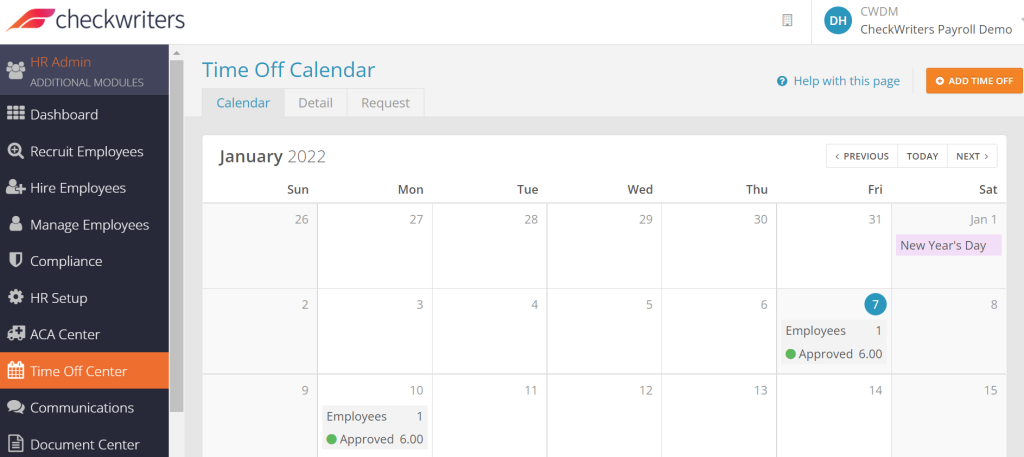

Compare payroll data with time and attendance records to ensure that employees are paid only for the hours they actually worked. Look for any discrepancies, such as employees being paid for overtime they didn’t work or paid during periods of absence. Any irregularities here should be flagged for further investigation.

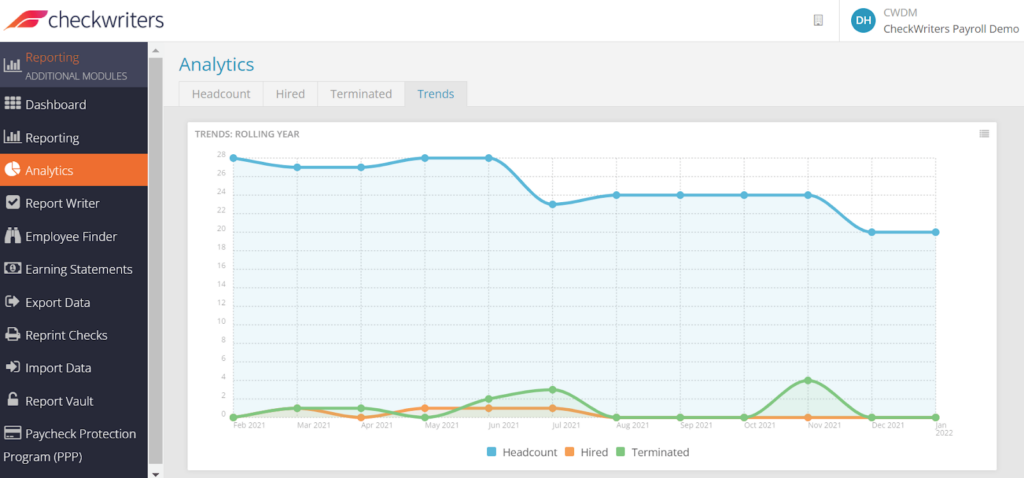

Step 4: Analyze Payroll Data for Unusual Patterns

Use analytics to identify trends or anomalies in payroll data. For example, look for employees who are consistently working excessive overtime or receiving pay raises without a clear reason.

Identifying patterns that deviate from the norm can help highlight areas where fraud might be taking place, like excessive overtime claims or suspicious salary changes.

Step 5: Monitor for Duplicates or Suspicious Bank Accounts

Check for duplicate bank account details or multiple payments made to the same account. Fraudsters might manipulate payroll records to divert funds into their own accounts. Ensure that bank account numbers are legitimate and properly matched to the employee.

Step 6: Investigate Reports from Employees

Encourage employees to speak up if they notice any unusual payroll behavior. Whistleblower reports can help flag suspicious activities that may otherwise go unnoticed. If employees report discrepancies, take their concerns seriously and investigate any red flags.

How to Prevent Payroll Fraud

Establish Clear Payroll Procedures

Make sure everyone involved in the payroll process understands the procedures for submitting timesheets, reporting hours, and requesting pay adjustments. Clear procedures ensure that employees and payroll staff know exactly how to handle all payroll-related tasks, which can minimize the chance for fraud.

Communicate Payroll Deadlines and Expectations

Set and communicate clear deadlines for submitting timesheets and payroll information. When employees know exactly when they need to submit their hours or request changes, it reduces the likelihood of late or last-minute adjustments, which can be an opportunity for fraudulent activity.

Encourage Open Communication

Encourage employees to communicate openly with their managers or payroll team if they notice any discrepancies or if they suspect fraudulent activity. Creating a culture of transparency can help to catch any problems early.

Regularly Review Payroll Records

Encourage regular checks of payroll records by multiple people to ensure consistency. When there are multiple eyes on the payroll process, the chances of catching discrepancies or errors early are increased.

Conduct Spot Checks for Accuracy

Implement random, spot checks on payroll records from time to time. Random checks can help identify small mistakes or discrepancies before they become bigger problems. This keeps employees mindful of the accuracy of their records.

Create an Environment of Accountability

Hold all employees involved in payroll processing accountable for their work. Make it clear that any intentional errors or fraud will be taken seriously. This creates a deterrent for anyone considering manipulating payroll for personal gain.

Create a Strong Ethical Culture

Cultivate a culture where ethics and integrity are valued. When employees feel part of a workplace that upholds honesty and trust, they are more likely to act responsibly and report suspicious activities rather than participate in or ignore fraudulent behavior.

Make Payroll Information Accessible and Transparent

Make sure employees have easy access to their pay stubs and payroll records so they can double-check their pay for accuracy. Transparency can help employees spot errors before they escalate, and gives them confidence in the fairness of the process.

Best Practices for Recovering from Payroll Fraud

- Conduct a Thorough Investigation: Once payroll fraud is suspected or detected, perform a detailed investigation. This should include reviewing all payroll records, interviewing involved parties, and identifying the full extent of the fraud. This step is crucial for understanding how the fraud occurred and preventing future incidents.

- Correct and Recover Financial Losses: Take immediate steps to correct any overpayments, unauthorized bonuses, or fraudulent salary increases. Work with legal and financial teams to recover lost funds, where possible, and ensure that all employees are paid accurately moving forward.

- Reassess and Strengthen Controls: After identifying the flaws that allowed fraud to happen, revisit your internal controls. Implement tighter security measures, segregate duties more effectively, and update access restrictions to close any loopholes that fraudsters exploited.

- Communicate with Employees: Communicate openly with your staff about the fraud and the steps being taken to resolve the situation. Transparency fosters trust and shows employees that the company takes fraud seriously. Reassure employees that measures are in place to prevent future fraud.

- Provide Additional Training and Education: After resolving the issue, train employees on the updated payroll processes and the importance of fraud prevention. Educating your workforce helps to build a culture of integrity and makes it more likely that fraud will be detected early in the future.

Protect Your Organization from Payroll Fraud

Payroll fraud is a serious problem that can affect businesses of all sizes. By understanding the types of payroll fraud, how to detect it, and how to prevent it, you can take steps to protect your organization from financial loss and reputational damage.

Remember that payroll fraud isn’t always immediately apparent, so it’s important to be vigilant and proactive in your approach. By staying informed and adopting the right policies, you can safeguard your business and prevent payroll fraud from becoming a costly issue.

Ready to take action? Request a Checkwriters demo today to secure your payroll and access more resources and tools to help protect your organization from payroll fraud.

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.