Quick Summary

Why is biweekly payroll the most common of all? It’s because it helps you balance employee satisfaction and employer efficiency. Today we’ll explore what biweekly payroll is, its benefits along with its challenges, and how it works. Learn how to navigate the ins and outs of biweekly payroll and explore our blog to know more about streamlining payroll, ensuring compliance, and supporting your team effectively.

Looking to Implement Biweekly Payroll?

In February 2023, biweekly payroll was the most common pay period in the U.S., used by 43% of private establishments. This makes biweekly payroll one of the most common pay schedules, where employees are paid every two weeks.

In this Checkwriters guide, we’ll break down what biweekly payroll means, how it compares to other schedules, and the benefits it offers. But before we dive in…

Why Listen to Us?

At Checkwriters, we understand how crucial it is to keep payroll accurate and compliant while meeting your employees’ expectations.

For example, when faced with the challenge of modernizing their payroll and HR operations, the Diocese of Baker took the lead by partnering with us. Through their proactive approach, the Diocese significantly enhanced operational efficiency and unlocked new possibilities for diocesan management.

What Is Biweekly Payroll?

Biweekly payroll is a pay schedule where employees receive wages every two weeks, resulting in 26 pay periods annually. This schedule is common for organizations aiming for consistent payment cycles and easier budget management for both employers and employees.

Certain industries practise biweekly payroll due to the nature of their workforce, such as:

- Healthcare

- Retail

- Hospitality

- Education

- Information

- Government

- Corporate offices

It’s particularly popular in sectors with hourly or salaried employees requiring predictable, straightforward pay distribution.

To calculate biweekly pay, employers divide annual salaries by 26 or total hourly wages by the pay period’s hours. This ensures consistent payment regardless of months with an extra payday.

Biweekly payroll is ideal for organizations that value regular pay schedules, need to align with employee expectations, or small to mid-sized organizations that want to streamline accounting. It’s a flexible option balancing employer efficiency with employee satisfaction.

Biweekly Payroll Vs. Semi-Monthly Payroll

Biweekly and semi-monthly payroll schedules differ in pay frequency, consistency, and complexity. Here are three key distinctions to help decide which suits your business needs:

| Biweekly Payroll | Semi-Monthly Payroll | |

| Pay Frequency | Involves 26 pay periods per year | Involves 24 pay periods per year |

| Employees receive paychecks every two weeks | Employees receive paychecks twice a month | |

| Payday Consistency | Falls on the same weekday, offering predictability | Varies by calendar date, such as the 1st and 15th |

| Calculation Complexity | Simplifies calculations with consistent pay cycles | Requires adjustments for irregular pay periods |

Benefits of Biweekly Payroll

Consistency in Pay Schedule

Biweekly payroll makes sure employees are paid consistently every two weeks, offering predictability that enhances financial planning for both workers and employers. This regularity can reduce stress for employees by aligning paydays with recurring expenses like rent or utility bills.

Such consistency is important because:

- Employees rely on steady paydays to manage their finances effectively.

- Employers can better align payroll cycles with cash flow and budget management.

- Predictable schedules build trust and improve employee satisfaction, especially for hourly workers who benefit from routine payouts.

This structured approach minimizes confusion compared to irregular or semi-monthly schedules, where payday variations might complicate financial forecasting. Biweekly payroll’s consistency directly supports workforce stability and operational efficiency.

Easier Budgeting for Employers

Biweekly payroll simplifies financial management by providing consistent cash flow requirements every two weeks. This regularity helps employers predict and allocate resources effectively, minimizing the risk of payroll-related disruptions.

Key advantages include:

- Aligning payroll with revenue cycles for smoother financial operations.

- Simplifying cost forecasting by standardizing payroll schedules.

- Reducing errors through repetitive, predictable processes.

This structure is especially beneficial for businesses with fluctuating revenues, as it enables better planning while maintaining employee trust through consistent and timely payments.

Simplified Overtime Calculations

Biweekly payroll streamlines overtime calculations by aligning pay periods with standard work weeks. This eliminates discrepancies caused by semi-monthly schedules that split weeks unevenly, reducing errors and ensuring compliance with labor regulations.

Benefits of biweekly overtime calculations include:

- Accurate tracking of hours worked within each pay period.

- Easier compliance with Fair Labor Standards Act (FLSA) requirements.

- Reduced administrative burden for payroll teams managing variable schedules.

This approach is particularly advantageous for industries with fluctuating workloads, helping maintain transparency and avoid costly payroll mistakes.

Challenges of biweekly payroll

Increased Payroll Processing Frequency

Biweekly payroll increases the number of pay runs from 24 to 26 per year, which can amplify administrative workload and associated costs. This challenge is particularly pronounced for businesses processing payroll manually or without automated systems in place.

Key considerations include:

- Additional payroll processing tasks like wage calculations, tax filings, and report generation.

- Higher cumulative costs for payroll services, especially for third-party providers charging per pay run.

- Potential strain on HR or finance teams during high-demand periods.

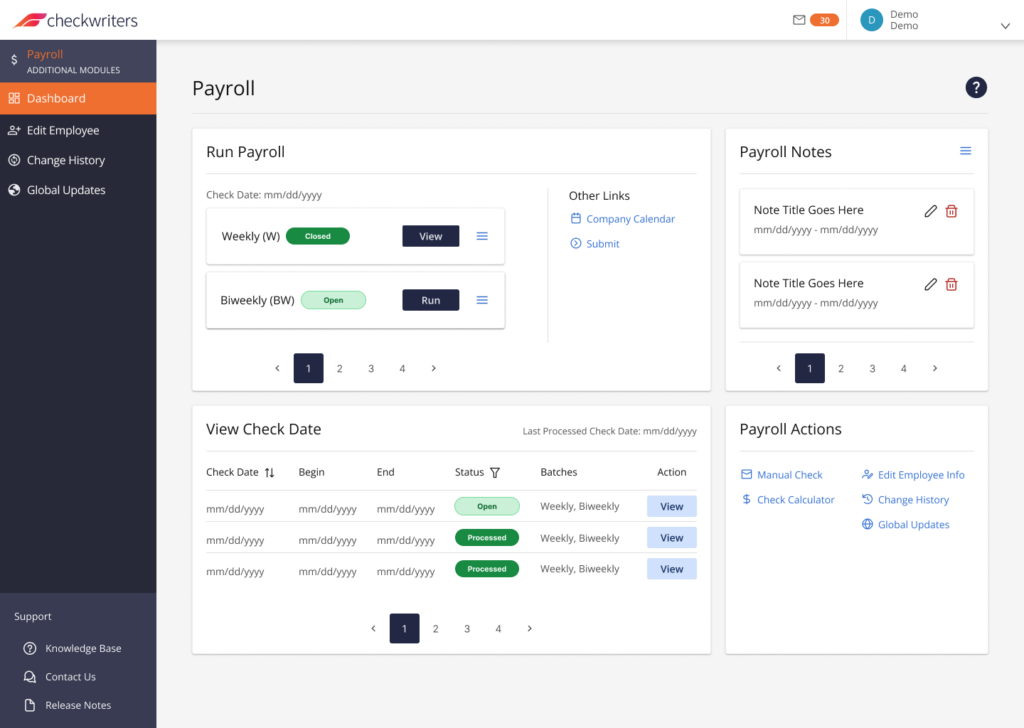

Employers can address these challenges with automated payroll solutions, like Checkwriters, that streamline such repetitive tasks and ensure accuracy across more frequent cycles.

Leveraging our platform’s automation reduces manual effort, minimizes errors, and mitigates the added workload of processing payroll every two weeks.

Irregular Monthly Cash Flow

Biweekly payroll introduces variability in monthly cash flow, as some months have three pay periods instead of the usual two. This can create budgeting challenges for employers unprepared for the additional payout frequency.

To mitigate this issue, businesses should:

- Monitor and forecast cash flow across the year to account for three-paycheck months.

- Reserve funds in advance to handle these fluctuations smoothly.

Using automated payroll systems like Checkwriters can help streamline forecasting and ensure consistent financial planning for these irregularities.

Complications with Benefit Deductions

Biweekly payroll creates complexity in managing benefit deductions like health insurance or retirement contributions, especially during months with three pay periods. Employers must decide whether to spread deductions evenly or skip them in the extra pay period.

To address these complications, consider:

- Aligning benefit deductions with biweekly cycles to ensure consistency.

- Implementing clear employee communication about deduction schedules, especially for months with skipped or adjusted contributions.

- Automating payroll processes to track deductions and avoid manual errors.

At Checkwriters, we simplify these tasks by automating calculations and managing compliance, helping employers manage deductions effectively across the year.

How Does Biweekly Payroll Work?

1. Determine Employee Pay Rates and Hours

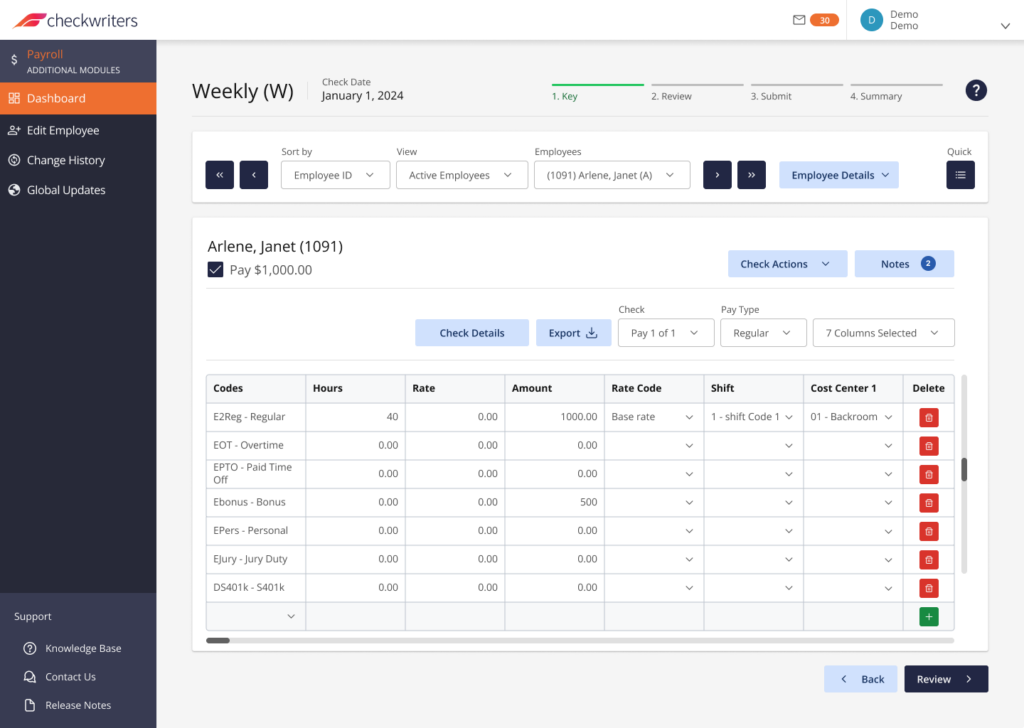

To calculate biweekly payroll, determine each employee’s gross pay based on their hourly rate or annual salary. Multiply hourly rates by hours worked or divide annual salaries by 26 pay periods for salaried employees.

Let’s say, as the owner of a retail store, you hire five employees. Two are full-time associates with annual salaries of $40,000 each, and three are part-time cashiers earning $15 per hour. You designate biweekly paydays to streamline payroll and maintain consistency.

Here are some key considerations you need to take:

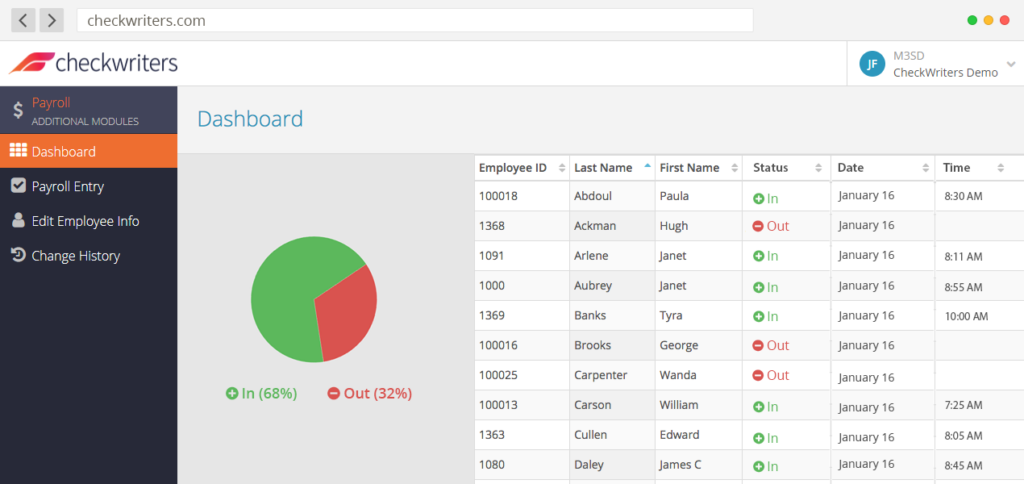

- Accurately tracking hours worked during the two-week period for hourly employees.

- Including overtime, shift differentials, or bonuses, if applicable.

- Verifying proper classification of employees (exempt vs. non-exempt).

Our time and attendance tracking simplify this step by ensuring accurate and consistent data for payroll calculations.

2. Include Deductions and Taxes

Accurately apply deductions and taxes to calculate each employee’s net pay. This step involves determining required withholdings and ensuring compliance with federal, state, and local regulations. Missteps can lead to costly penalties or employee dissatisfaction.

Common considerations for such deductions include:

- Mandatory Taxes: Federal income tax, Social Security, and Medicare.

- Voluntary Deductions: Retirement contributions, health insurance, or flexible spending accounts.

- Court-Ordered Garnishments: Child support or tax liens, if applicable.

Let’s continue the previous scenario.

For a full-time associate earning $1,538.46 biweekly, you calculate taxes and deductions, including 15% federal and state taxes, $50 for health insurance, and 6.2% Social Security.

After deductions, their take-home pay is $1,168.46.

Accurate deduction and tax calculations like this not only ensure compliance but also foster trust and transparency with employees. By meticulously accounting for these details, employers can provide their workforce with the confidence that their pay is handled fairly and professionally.

3. Process and Distribute Payroll

Finalize payroll calculations and ensure accurate payments reach employees on the scheduled biweekly payday. This step includes verifying all data, processing payments, and maintaining detailed records for compliance and audits.

Essential tasks include:

- Reviewing gross pay, deductions, and net pay for errors.

- Processing payments via direct deposit or physical checks.

- Generating pay stubs with detailed earnings and deductions information.

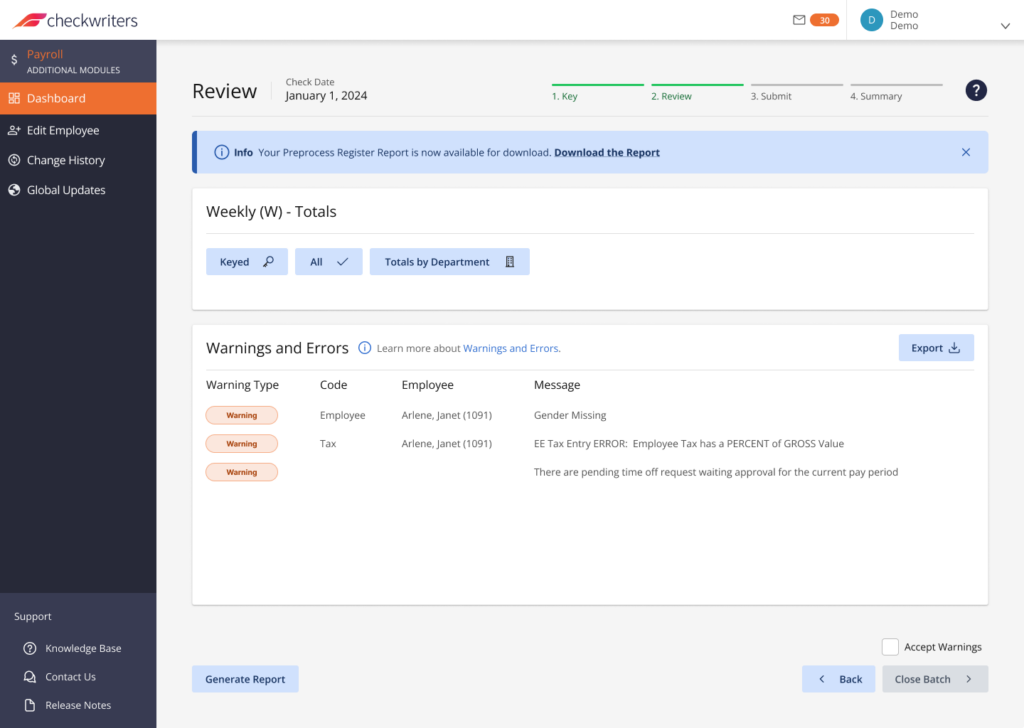

We help automate payment distribution and provide secure, accessible records, reducing errors and saving time for payroll teams.

For instance, using our payroll software, you input the calculated amounts for all employees. The software processes payments and sends direct deposits, ensuring accuracy and managing compliance with payroll regulations.

Streamline Biweekly Payroll with Checkwriters

Biweekly payroll offers consistency, reliability, and flexibility for managing employee compensation. While it comes with its own set of challenges, these can be effectively managed with the right tools and processes in place.

At Checkwriters, we simplify biweekly payroll with automated calculations, time tracking, and compliance support. Our platform ensures accuracy and efficiency, so you can focus on growing your organization while meeting your team’s needs.Start streamlining your biweekly payroll process by contacting Checkwriters today.