Quick Summary

Managing payroll for a large business requires precision, compliance, and efficiency. In this article, we review the best payroll software solutions, comparing features like automation, tax compliance, HR integration, and scalability. Whether you need global payroll capabilities, real-time analytics, or seamless employee self-service, we break down the top options to help you find the right fit.

Looking for the Best Payroll Software for Your Business?

Payroll errors cost businesses time and money. Without automation, manual payroll processes increase risks.

Businesses using payroll software experience 31% fewer errors, highlighting the importance of automation in ensuring accuracy and compliance, especially for large businesses.

In this Checkwriters article, we’ll guide you through our list of the 10 best payroll software for large businesses, helping you choose the right one.

Why Listen to Us?

At Checkwriters, we deliver a full-suite payroll and HR solution designed for large organizations.

For instance, to enhance their administrative efficiency, Katz Hillel Day School partnered with us, implementing a fully integrated Payroll and HR solution. This collaboration streamlined their operations, allowing the school to focus more effectively on their educational mission.

What Is Payroll Software?

Payroll software is a digital tool that automates wage calculation, tax filings, and compliance. It processes salaries, tracks deductions, and generates pay stubs efficiently, ensuring businesses meet pay obligations while reducing manual errors.

It often integrates with HR systems to streamline other HR functions like time tracking, benefits management, and reporting.

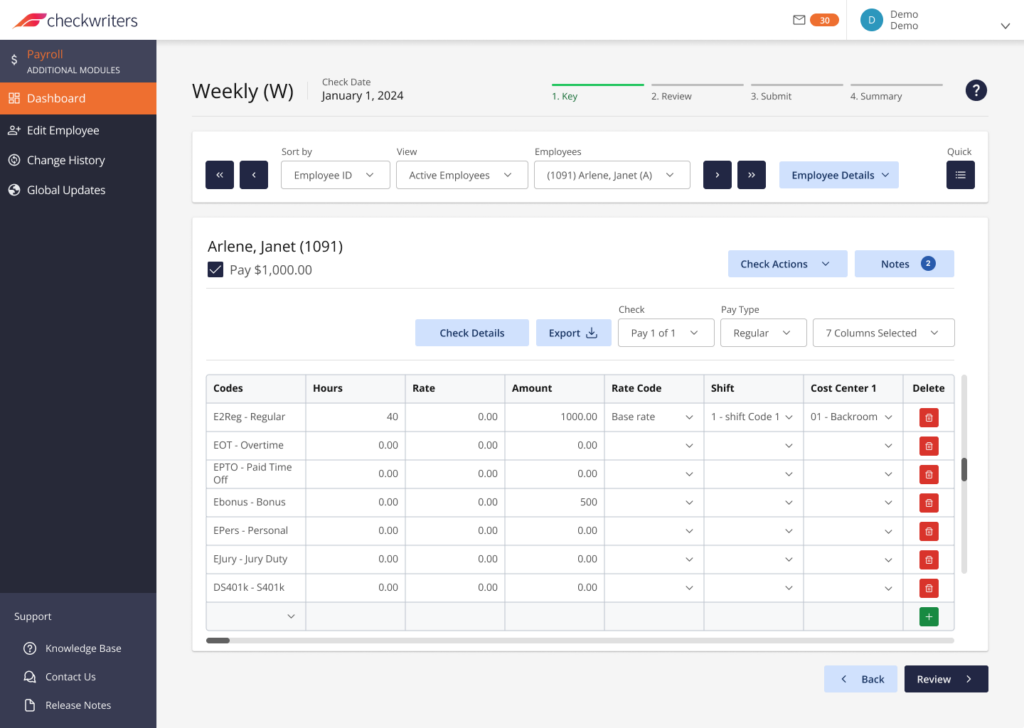

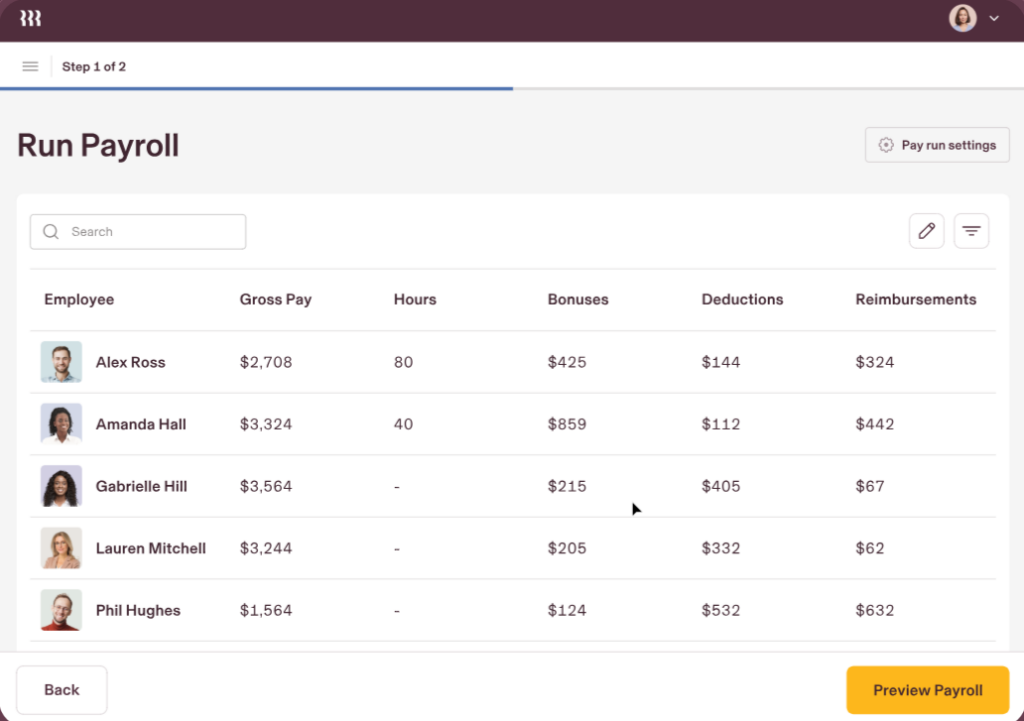

For instance, Checkwriters comes with a streamlined, user-friendly interface for managing employee payments, tracking hours, handling deductions, and ensuring accurate payroll processing with customizable pay types and cost centers.

Why Do Large Businesses Need Payroll Software?

- Automation & Accuracy – Reduces errors in wage calculations, tax filings, and benefits deductions, ensuring employees are paid correctly and on time.

- Regulatory Compliance – Keeps businesses compliant with tax laws, wage regulations, and labor requirements.

- Scalability – Adapts to a growing workforce, handling multi-location payroll, multi-state taxes, and benefits management seamlessly.

- Integration with HR – Essential for syncing with time tracking, onboarding, and performance tools for a unified HR system.

- Employee Self-Service – Provides access to pay stubs, tax forms, and benefits, reducing HR workload and improving employee satisfaction.

Best Payroll Software for Large Businesses

- Checkwriters

- Workday

- Dayforce

- UKG Pro

- Oyster HR

- Oracle PeopleSoft

- Deel

- TriNet

- Namely

- Rippling

1. Checkwriters

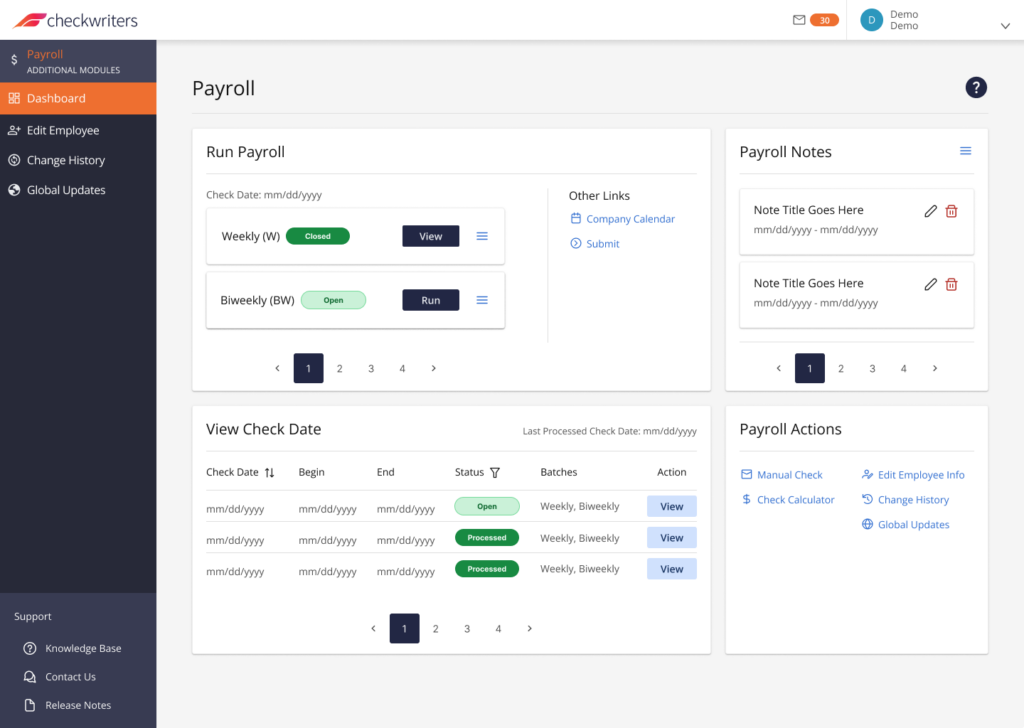

Checkwriters is a comprehensive payroll and human resources platform designed to streamline HR processes and enhance the employee experience. Our platform offers a range of features tailored to meet the needs of organizations seeking efficient payroll and HR management solutions.

Key Features:

- Payroll Processing: Automates wage calculations and compliance tracking to ensure accurate and timely payroll management.

- Applicant Tracking & Background Screening: Facilitates recruitment by managing job applications and conducting background checks within the platform.

- Onboarding: Provides a digital onboarding system for new hires, including document handling and training modules, to streamline the integration of new employees.

- Attendance Tracking: Monitors employee time and attendance, ensuring accurate payroll and aiding in workforce management.

- Mobile App Access: Enables employees and managers to access payroll and HR services on the go, enhancing flexibility and engagement.

Pricing:

We offer customized pricing based on the specific requirements of each organization. To obtain detailed pricing information and a tailored quote, we recommend you request a demo through our website.

Pros:

- Intuitive system that is easy to navigate, reducing the learning curve.

- Handles complex payroll scenarios, including multi-state taxes and various pay structures.

- Prompt and helpful customer service, ensuring issues are resolved quickly.

- Streamlines the onboarding of new employees, reducing manual paperwork.

- Provides detailed payroll reports, offering valuable insights into payroll expenses.

- Integrates well with accounting systems, enhancing overall operational efficiency.

Cons:

- Some users feel that the available documentation could be more comprehensive.

- Employees have reported difficulties with the password reset feature.

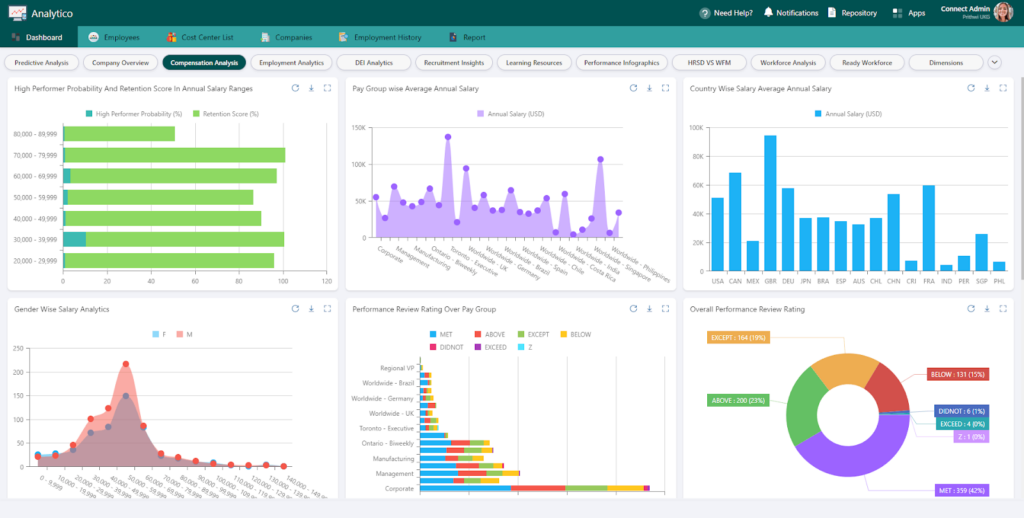

2. Workday

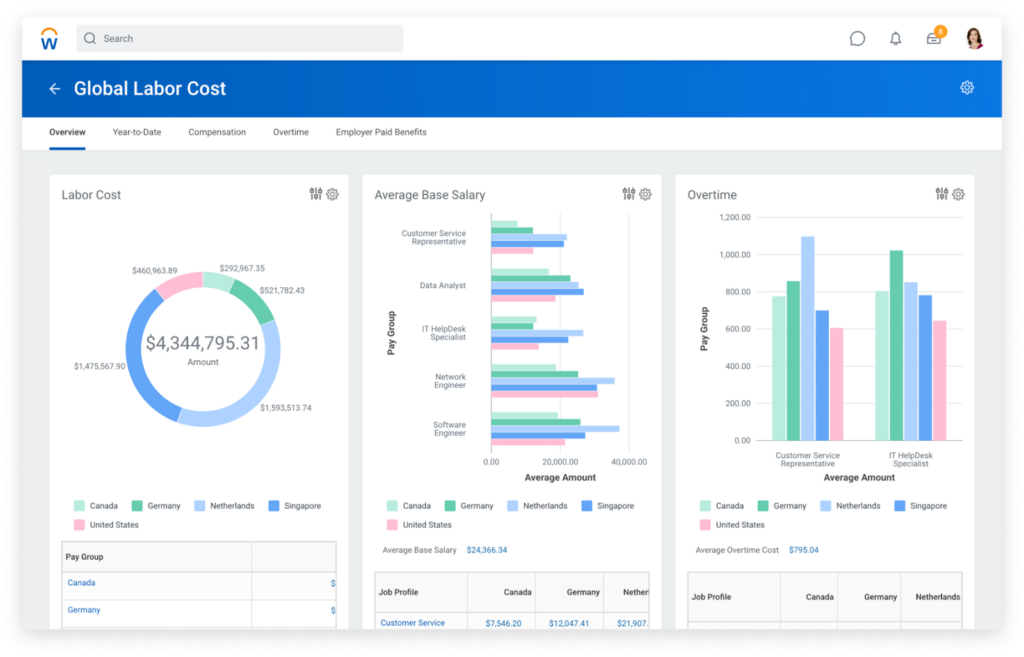

Workday is a cloud-based Human Capital Management (HCM) platform designed for large enterprises. It offers comprehensive tools to manage HR, payroll, and financial operations, providing real-time insights and scalability.

Key Features:

- Payroll Management: Automates payroll processing, ensuring accurate calculations and timely disbursements.

- Time Tracking: Captures employee work hours efficiently, integrating seamlessly with payroll.

- Benefits Administration: Manages employee benefits programs, facilitating enrollment and tracking.

- Talent Management: Supports recruitment, performance evaluations, and succession planning.

Pricing:

Workday’s pricing varies based on company size and selected modules.

For organizations with fewer than 500 employees, annual costs range from $150,000 to $300,000. Larger enterprises may incur higher expenses. Implementation fees typically equal the annual subscription cost.

Pros:

- Intuitive design simplifies navigation for users.

- Adapts to growing organizational needs.

- Provides up-to-date data for informed decision-making.

- Integrates various HR functions into one platform.

- Offers a mobile app for on-the-go access.

- Continuously improves features based on user feedback.

Cons:

- Initial setup can be expensive for some organizations.

- Tailoring the system to specific needs may require significant effort.

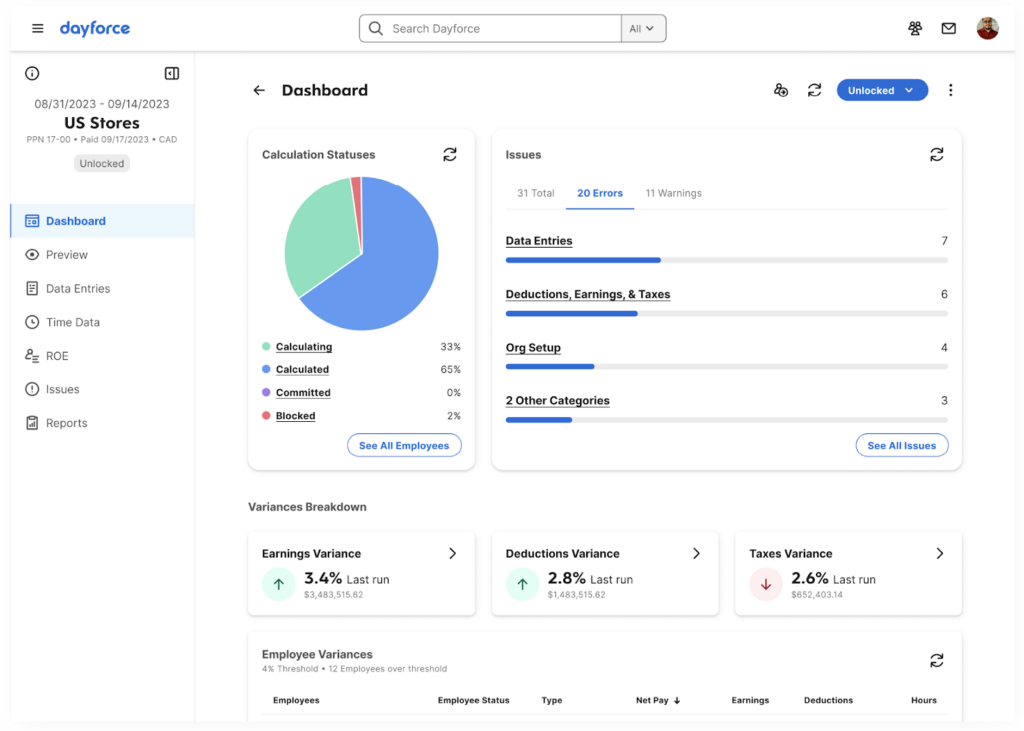

3. Dayforce

Dayforce is a cloud-based Human Capital Management (HCM) platform that integrates payroll, HR, benefits, talent, and workforce management into a single application. Designed for large enterprises, it provides real-time data access to enhance decision-making and operational efficiency.

Key Features:

- Payroll Processing: Automates payroll calculations, tax filings, and compliance management, ensuring timely and accurate employee payments.

- Workforce Management: Manages employee scheduling, time tracking, and attendance, optimizing labor costs and productivity.

- Talent Management: Supports recruitment, onboarding, performance evaluations, and succession planning to develop and retain top talent.

- Benefits Administration: Facilitates employee benefits enrollment and management, streamlining open enrollment and life event changes.

Pricing:

Dayforce’s pricing ranges from $22 to $31 per employee per month, depending on company size and selected modules. Implementation fees are typically 40-60% of the annual software costs.

Pros:

- Intuitive design simplifies navigation and reduces training time.

- Provides up-to-date information for informed decision-making.

- Offers a wide range of tools that streamline HR operations.

- Adapts to the needs of growing organizations.

- Allows employees to access information and perform tasks via mobile devices.

- Generates detailed reports to support strategic planning.

Cons:

- Regular updates may require ongoing user adaptation.

- Some users report delays in receiving support assistance.

4. UKG Pro

UKG Pro is a comprehensive Human Capital Management (HCM) solution designed for mid to large-sized enterprises. It integrates HR, payroll, talent management, and workforce analytics into a unified platform, enhancing organizational efficiency.

Key Features:

- Payroll Processing: Automates payroll calculations, tax withholdings, and direct deposits, ensuring timely and accurate employee compensation.

- Time and Attendance: Tracks employee hours, manages leave requests, and integrates data seamlessly into payroll.

- Talent Management: Facilitates recruitment, onboarding, performance evaluations, and succession planning to nurture employee growth.

- Workforce Analytics: Provides real-time insights into workforce metrics, aiding strategic decision-making.

Pricing:

UKG Pro operates on a subscription model, with costs ranging from $27 to $37 per employee per month, depending on company size and selected modules. Implementation fees are typically 40-70% of the annual software costs.

Pros:

- Integrates HR, payroll, and talent management into one system.

- Intuitive design simplifies navigation and reduces training time.

- Offers in-depth workforce insights for informed decision-making.

- Adapts to growing organizational needs.

- Provides a mobile app for on-the-go access.

- Offers responsive assistance and resources.

Cons:

- Setup can be time-consuming and may require technical expertise.

- Premium pricing may be prohibitive for smaller organizations.

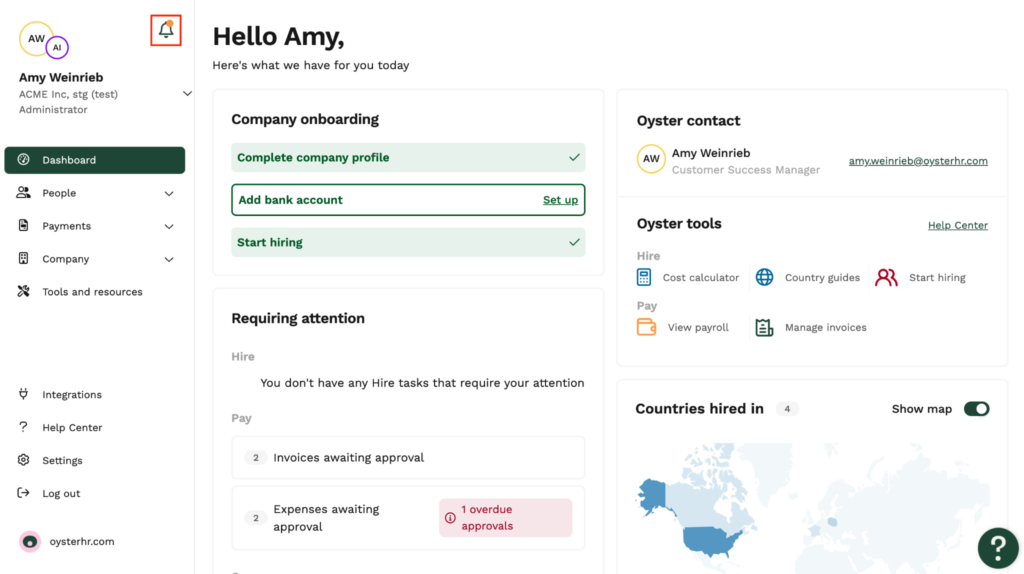

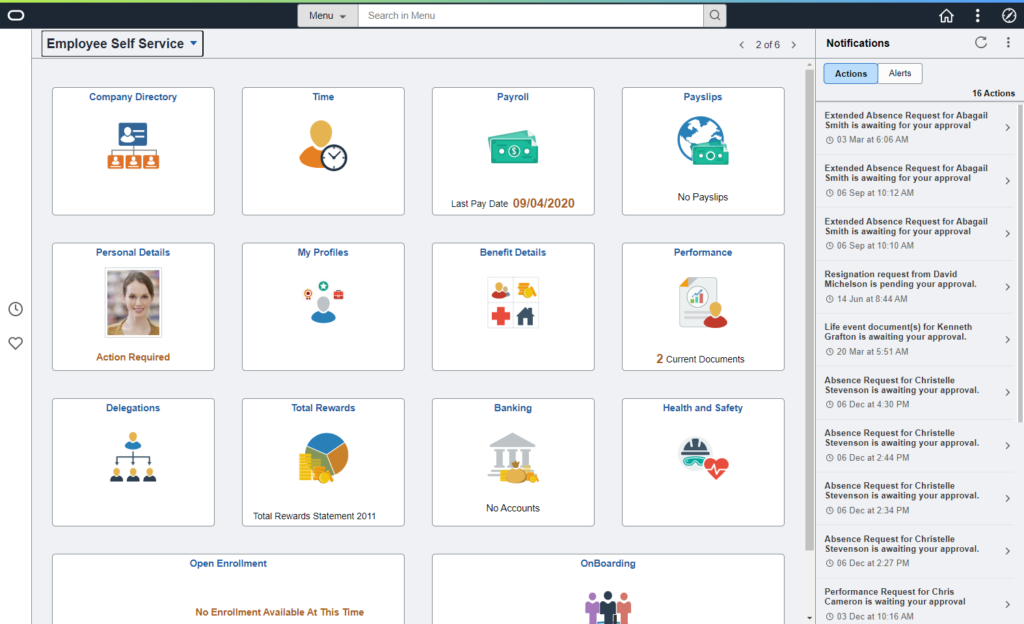

5. Oyster HR

Oyster HR is a global Human Resources platform designed to facilitate hiring, paying, and managing a distributed workforce across over 180 countries. It offers comprehensive solutions for payroll, compliance, and benefits administration, enabling businesses to expand internationally with ease.

Key Features:

- Global Payroll Management: Automates payroll processing in multiple countries, ensuring compliance with local tax laws and regulations.

- Compliance Management: Provides in-depth knowledge of country-specific employment laws to maintain compliance and reduce legal risks.

- Employee Self-Service Portal: Empowers employees to access payslips, manage personal information, and request time off through a user-friendly interface.

- Multi-Currency Support: Facilitates payments in over 180 currencies, allowing employees to receive compensation in their local currency.

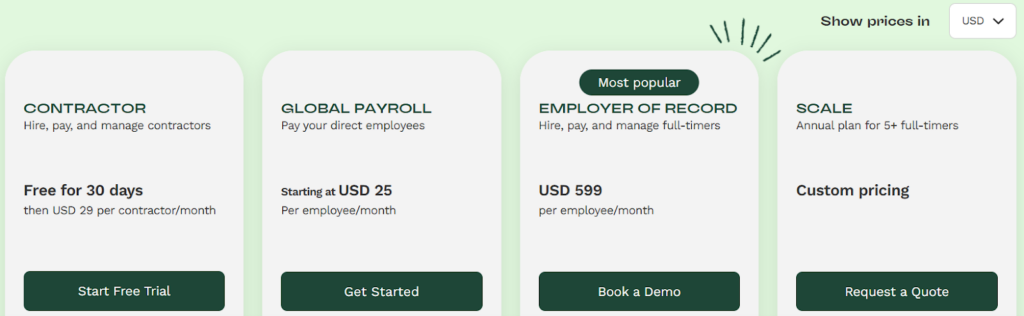

Pricing:

Oyster HR offers a transparent pricing model with various plans:

- Contractor Plan: Free for the first 30 days, then $29 per contractor per month for managing and paying global contractors.

- Global Payroll: Starts at $25 per employee per month for payroll services for companies that have their own entities.

- Employer of Record (EOR): $599 per employee per month, providing full HR, payroll, and compliance support for international hiring.

- Scale Plan: Custom pricing for businesses hiring 5+ full-time employees on an annual plan.

Pros:

- Enables hiring and payroll management in over 180 countries.

- Intuitive interface simplifies HR tasks for both administrators and employees.

- Clear pricing structure with no hidden fees.

- Facilitates quick and compliant onboarding of international employees.

- Offers extensive resources to navigate complex local labor laws.

- Responsive support team assists with HR and payroll inquiries.

Cons:

- Some services may not be available in all desired locations.

6. Oracle PeopleSoft

Oracle PeopleSoft is a comprehensive Human Capital Management (HCM) solution tailored for large enterprises. It integrates HR, payroll, and time management functionalities to streamline workforce administration and ensure compliance with complex regulatory requirements.

Key Features:

- Payroll Processing: Calculates gross-to-net earnings, deductions, and taxes, ensuring accurate and timely payroll management.

- Time and Labor Management: Captures employee work hours and integrates seamlessly with payroll for precise compensation.

- Benefits Administration: Manages employee benefits programs, facilitating enrollment and compliance with regulations.

- Global Payroll Support: Provides support for international payroll processing, accommodating diverse regulatory environments.

Pricing:

Oracle’s PeopleSoft pricing structure is modular. Each module is priced per user or per employee, with associated software update licenses and support fees.

For example, the Human Resources module is listed at $185 per employee, with an additional $40.70 for support. Similarly, the Payroll module is priced at $225 per employee, plus $49.50 for support. Modules like Benefits Administration and Time and Labor have their own per-employee pricing and support costs.

Pros:

- Integrates HR, payroll, and time management functionalities.

- Adapts to the needs of large, complex organizations.

- Ensures accurate calculations and compliance with regulations.

- Supports international payroll processing.

- Seamlessly connects with other enterprise systems.

- Continuously improves features based on user feedback.

Cons:

- Setup can be time-consuming and may require technical expertise.

- Some users find the interface less intuitive compared to modern platforms.

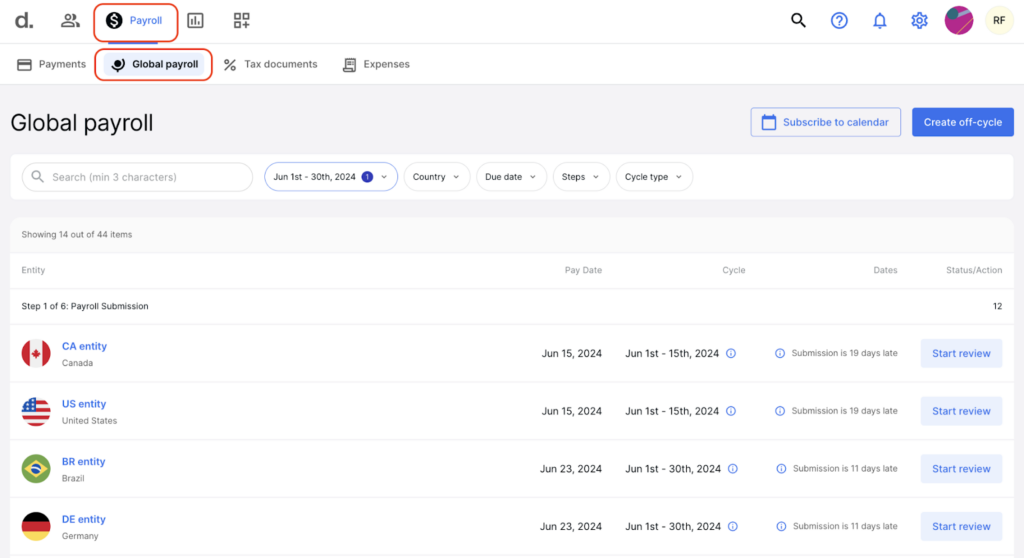

7. Deel

Deel is a comprehensive global payroll and compliance platform designed to facilitate international hiring and payments. It enables businesses to seamlessly onboard, manage, and pay employees and contractors across over 150 countries, ensuring compliance with local labor laws and tax regulations.

Key Features:

- Global Payroll: Automates payroll processing in multiple currencies, ensuring timely and accurate payments to international teams.

- Compliance Management: Provides localized contracts and handles tax filings, adhering to country-specific labor laws to mitigate compliance risks.

- Contractor Management: Simplifies onboarding and payment processes for contractors, including automated invoicing and flexible payment options.

- Employee of Record (EOR) Services: Acts as the legal employer for international employees, managing HR responsibilities such as benefits administration and compliance.

Pricing:

Deel offers a tiered pricing structure for hiring and payroll:

- Contractor: Starts at $49 per contractor per month.

- Employee of Record (EOR): Begins at $599 per employee per month.

Pros:

- Intuitive design simplifies navigation and reduces training time.

- Supports operations in over 150 countries, facilitating extensive international reach.

- Offers multiple payment methods, including bank transfers, PayPal, and cryptocurrency.

- Provides localized contracts and manages tax filings to ensure adherence to local laws.

- Streamlines the onboarding of international employees and contractors with localized contracts and automated workflows.

- Clear pricing structure with no hidden fees.

Cons:

- Some users have reported difficulties in reaching customer support for timely assistance.

- May lack some advanced HR functionalities compared to dedicated HR platforms.

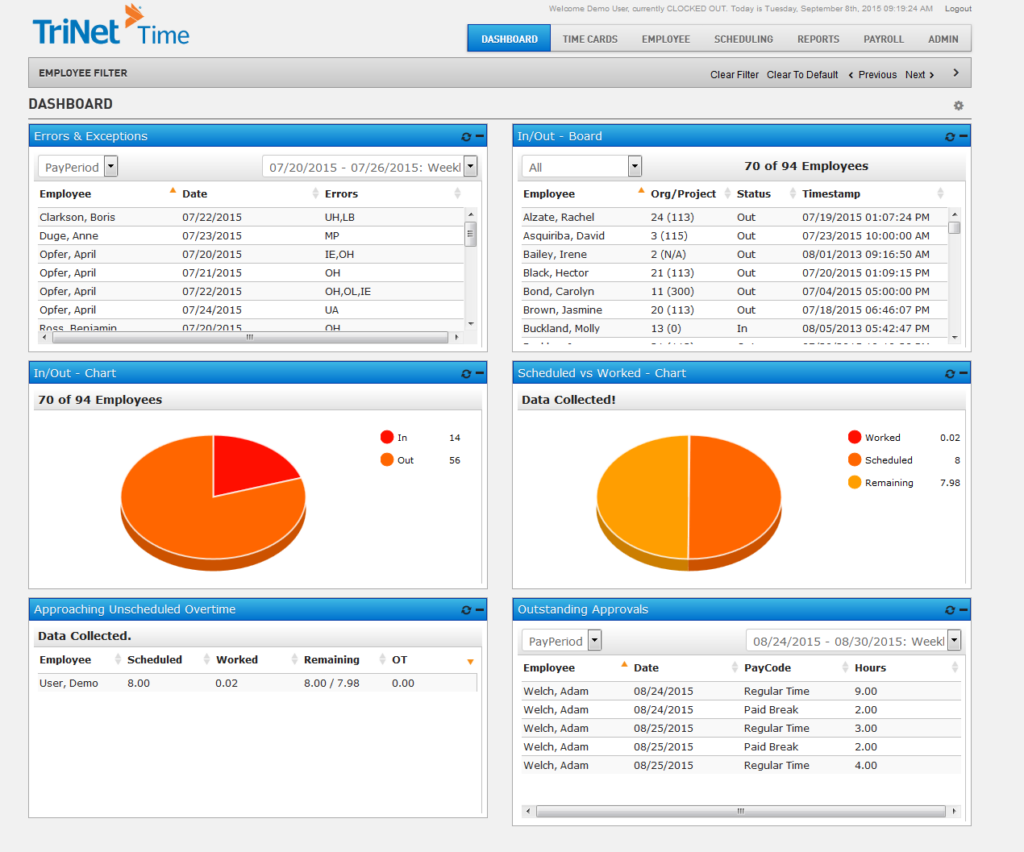

8. TriNet

TriNet is a Professional Employer Organization (PEO) that provides comprehensive HR solutions tailored for small to mid-sized businesses. By offering services such as payroll processing, benefits administration, and risk mitigation, TriNet enables companies to focus on their core operations while ensuring efficient human resources management.

Key Features:

- Payroll and Tax Administration: Automates payroll processing, including tax calculations and filings, ensuring compliance with federal, state, and local regulations.

- Benefits Management: Provides access to competitive health, dental, vision, and retirement plans, leveraging TriNet’s partnerships with leading insurance carriers.

- Risk and Compliance: Offers guidance on HR compliance issues, helping businesses navigate complex employment laws and mitigate potential risks.

- Time and Attendance Tracking: Includes tools for tracking employee hours, managing time-off requests, and integrating data seamlessly into payroll.

Pricing:

TriNet’s pricing is customized based on factors such as company size, industry, and selected services. Administrative fees typically range from $100 to $140 per employee per month. For an accurate quote, businesses should contact TriNet directly.

Pros:

- Offers a wide range of HR solutions, including payroll, benefits, and compliance support.

- Leverages partnerships to provide employees with high-quality benefit options.

- Tailors services to meet the evolving needs of growing businesses.

- Provides industry-specific HR support, ensuring relevant and effective solutions.

- Empowers employees to manage personal information, benefits, and payroll details independently.

- Assists businesses in adhering to complex employment laws and regulations.

Cons:

- Pricing may be higher compared to other PEOs, which could be a concern for budget-conscious organizations.

- Some users find the platform’s interface less user-friendly, leading to a steeper learning curve.

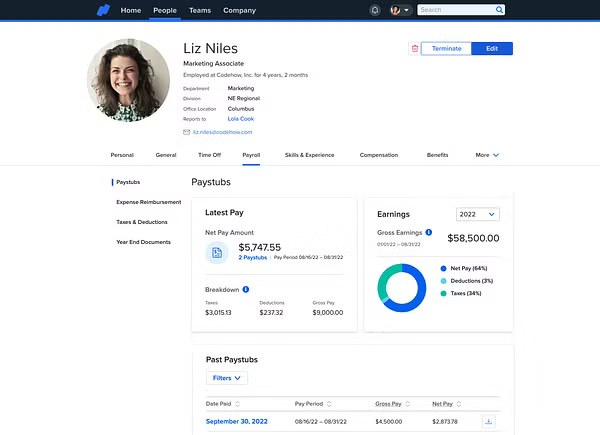

9. Namely

Namely is a cloud-based Human Resources Information System (HRIS) tailored for mid-sized businesses. It integrates HR, payroll, benefits, and talent management into a single platform, enhancing employee engagement and administrative efficiency.

Key Features:

- Payroll Processing: Automates payroll calculations, tax filings, and compliance management, ensuring accurate and timely payments.

- Benefits Administration: Simplifies employee benefits enrollment and management, including health, dental, and vision plans.

- Time and Attendance Tracking: Allows employees to log work hours from any device, facilitating accurate timekeeping and payroll integration.

- Employee Onboarding: Automates the onboarding process with digital offer letters, background checks, and document management.

Pricing:

Namely offers a flexible pricing structure to accommodate various business needs. Their packages start at $9 per employee per month, with the final cost depending on the specific modules and services selected.

For a detailed breakdown of available packages and features, you can visit Namely’s pricing page.

Pros:

- Intuitive design simplifies navigation and reduces training time.

- Integrates various HR functions into a single platform.

- Empowers staff to manage their information independently.

- Facilitates dynamic, ongoing performance conversations.

- Seamlessly connects with third-party applications.

- Offers a clean and inviting user interface.

Cons:

- Lacks pulse surveys and applicant tracking system.

- Some users report slow customer service responses.

10. Rippling

Rippling is a unified workforce management platform that integrates HR, IT, and finance operations into a single system. Designed for businesses of all sizes, it streamlines processes such as payroll, benefits administration, device management, and application access, enhancing overall organizational efficiency.

Key Features:

- Payroll Automation: Automatically calculates payroll taxes and files them with the appropriate federal, state, and local agencies, ensuring compliance and accuracy.

- Benefits Administration: Manages employee benefits programs, including health insurance and 401(k) plans, with seamless integration into the payroll system.

- Device and App Management: Provides IT management capabilities, allowing organizations to manage employee devices and software access from a centralized platform.

- Time and Attendance Tracking: Enables employees to log work hours, with data automatically syncing to payroll for accurate compensation.

Pricing:

Rippling offers a modular pricing structure, starting at $8 per user per month for core HR functionalities. Additional modules, such as payroll and IT management, can be added based on organizational needs.

For a customized quote, prospective clients should contact Rippling directly.

Pros:

- Combines HR, IT, and finance functions into a single platform, reducing the need for multiple systems.

- Intuitive design simplifies navigation and reduces training time for employees and administrators.

- Adapts to the needs of growing organizations, allowing for the addition of new modules as required.

- Automates routine tasks, such as onboarding and offboarding, enhancing operational efficiency.

- Provides up-to-date analytics on workforce metrics, aiding in informed decision-making.

- Offers payroll processing capabilities for international employees, ensuring compliance with local regulations.

- Its modular approach makes it a top choice for businesses poised to grow quickly.

Cons:

- Some users have reported difficulties in reaching customer support for timely assistance.

- Initial setup and configuration may require significant time and technical expertise, particularly for organizations with complex requirements.

Checkwriters— the Best Payroll Software for Large Businesses

Choosing the right payroll software is essential for large businesses looking to streamline payroll, ensure compliance, and improve workforce management. Each tool on this list offers unique strengths, from automation to global payroll capabilities. For organizations seeking a customer-centric, all-in-one payroll and HR solution, Checkwriters stands out.

We simplify payroll management with compliance support and seamless HR integrations. Our robust reporting, mobile accessibility, and dedicated customer service make us an ideal choice for organizations that prioritize efficiency and accuracy.

See how we can transform your payroll process— request a Checkwriters demo today.

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.