Quick Summary

We explore 10 top Gusto alternatives, highlighting their key features, pricing, pros, and cons to help you find the perfect fit. From offering advanced compliance support to excelling in scalability and mobile access, we provide a detailed list of tools to guide your decision. Our platform, Checkwriters, stands out for its customer-focused approach and comprehensive features. Discover our blog to learn more on enhancing your HR and payroll processes.

Looking to Replace Gusto with a Tool that Fits Your Needs?

In 2024, over 940 companies globally adopted Gusto Payroll as their payroll and benefits management tool, reflecting its significant presence in the market. Despite all this, Gusto still might not be for every organization, especially if you prioritize good customer service.

That’s why we’re exploring the top 10 Gusto alternatives in this Checkwriters guide, each fitting different organizational needs.

But before that…

Why Listen to Us?

Our platform is the perfect HR solution due to our simple to use platform and responsive support. With proven success across industries like nonprofit, education, and the private sector, we build long-term relationships by addressing unique customer needs and driving efficiency.

For instance, the YMCA of Pawtucket streamlined its HR processes for 450 employees by leveraging our platform for compliance and payroll. Using our tailored features such as applicant tracking, the nonprofit organization reduced operational strain, allowing it to focus on community goals without resource inefficiencies.

What Is Gusto?

Gusto is a cloud-based platform designed to simplify payroll, benefits, and HR management for businesses. Key features include:

- Automated payroll processing

- Tax filing

- Benefits administration

- Time tracking

- Compliance tools

- Employee onboarding

- Integrates with various third-party applications.

Gusto offers employee self-service portals, detailed reporting, and customizable pay schedules. It also supports benefits like health insurance, 401(k) plans, and workers’ compensation. Organizations can use Gusto to manage remote teams, track time off, and manage legal compliance.

With an intuitive interface, Gusto helps streamline administrative tasks, reduce errors, and improve efficiency for small to mid-sized businesses. It also supports scaling with added features as businesses grow.

Gusto Limitations

While Gusto is a reliable option for some organizations, it does have its drawbacks:

- Cost Concerns: Gusto’s pricing may not align with certain budgets, especially for startups or small organizations.

- Feature Limitations: Missing advanced features like industry-specific tools, more robust reporting, or integrations with niche software. Also provides limited support for international payroll.

- Scalability Issues: Gusto may not meet the needs of larger businesses with complex payroll or HR requirements.

- Customer Support Concerns: Reports of slow or less-than-ideal customer service experiences.

- Customization Needs: Desire for more customizable features in payroll, benefits, or HR tools.

- Compliance Requirements: Businesses in heavily regulated industries may need specialized compliance features that Gusto doesn’t offer.

When choosing a Gusto alternative, make sure to evaluate your options based on:

- Integrations

- Report and analytics

- How much it streamlines HR operations

- Workflow automation

- Compliance

to find the one that best supports your team and goals.

Top 10 Gusto Alternatives for Effective HR Management

- Checkwriters

- Xero Payroll

- Rippling

- OnPay

- Justworks

- TriNet

- Square Payroll

- Patriot Software

- SurePayroll

- Toast Payroll

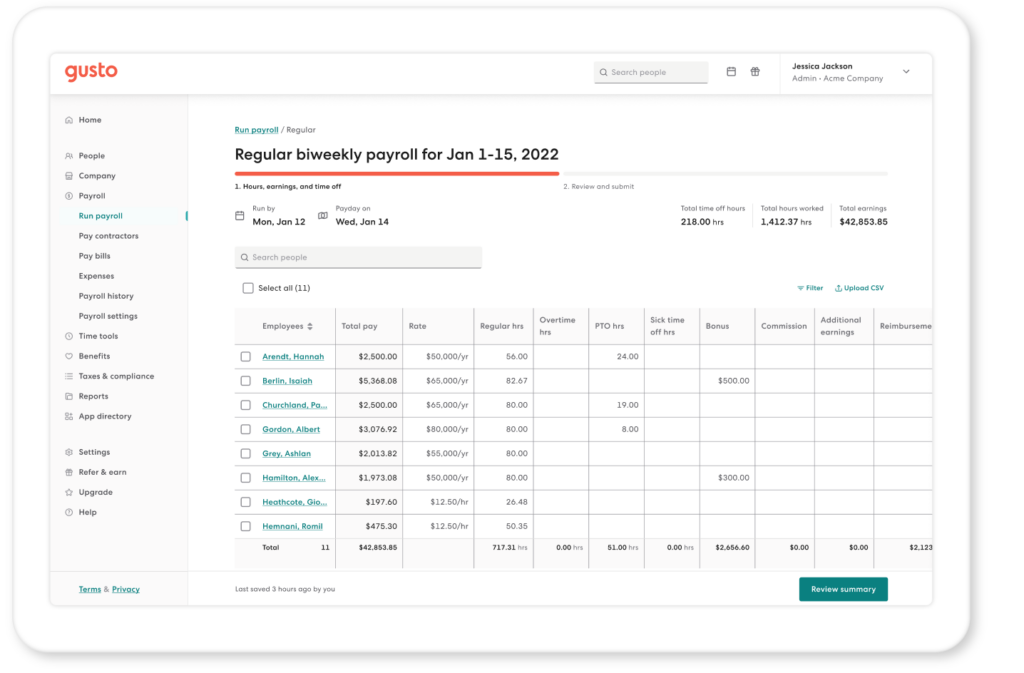

1. Checkwriters

Checkwriters is an all-in-one payroll and HR platform designed for organizations seeking seamless, accurate, and compliant employee management. Our platform combines essential tools like payroll processing, applicant tracking, and onboarding to streamline the entire employee lifecycle.

Key Features

- Automated Payroll Processing: Streamlines payroll management with flexible input, pre-process previews, employee self-service, and dedicated support.

- Applicant Tracking System (ATS): Streamlines your recruitment with helpful tools for job posting, candidate screening, communication, activity tracking, and background checks, ensuring an efficient and effective hiring process.

- Electronic Onboarding: Offers intuitive document handling, tracking, and more for new hires, while delivering all new hire data directly into your payroll and HR functions.

- Attendance Tracking: Tracks employee time and attendance in various flexible formats for payroll accuracy.

Pricing

We offer customized pricing based on your organization’s size and needs. Request a personalized quote to explore our options.

Pros

- Robust compliance tools and service that simplifies tax and payroll regulations.

- Mobile app providing access for employees and managers anytime, anywhere.

- Offers personalized training and dedicated support for users.

- Intuitive onboarding tools that improve the new hire experience for both employee and employer.

Cons

- Some users note a learning curve with advanced features, however one-on-one support is available.

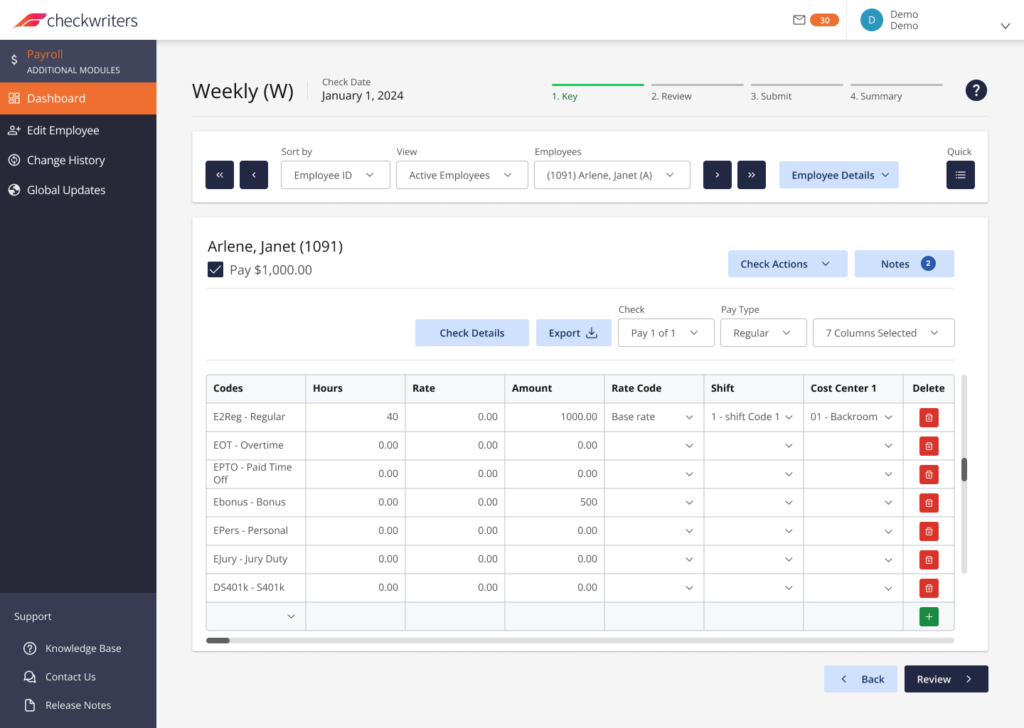

2. Xero Payroll

Xero Payroll is a cloud-based payroll solution integrated within Xero’s accounting software. Xero is designed to streamline payroll processing, tax calculations, and compliance for small to medium-sized businesses.

Key Features

- Automated Payroll Processing: Calculates employee wages, taxes, and deductions, ensuring accurate and timely payments.

- Tax Filing Compliance: Manages federal and state tax filings, keeping businesses compliant with regulations.

- Employee Self-Service: Allows employees to access pay stubs, tax documents, and personal information through a secure portal.

- Time Tracking Integration: Supports integration with time-tracking systems for precise payroll calculations.

- Direct Deposit: Facilitates secure and efficient employee payments directly to bank accounts.

Pricing

Xero offers three tiered pricing plans:

- Starter plan at $29 per month

- Standard plan at $46 per month

- Premium plan at $69 per month

with payroll features available in higher-tier plans.

Pros

- Seamless integration with Xero accounting software enhances financial management.

- User-friendly interface that simplifies payroll tasks.

- Automated tax calculations and filings reducing compliance risks.

- Employee self-service portal which improves accessibility.

- Scalable solutions accommodating growth.

- Comprehensive reporting tools supporting informed decision-making.

Cons

- Payroll features are limited to certain regions, primarily the U.S. and Australia.

- Advanced HR functionalities may require additional integrations.

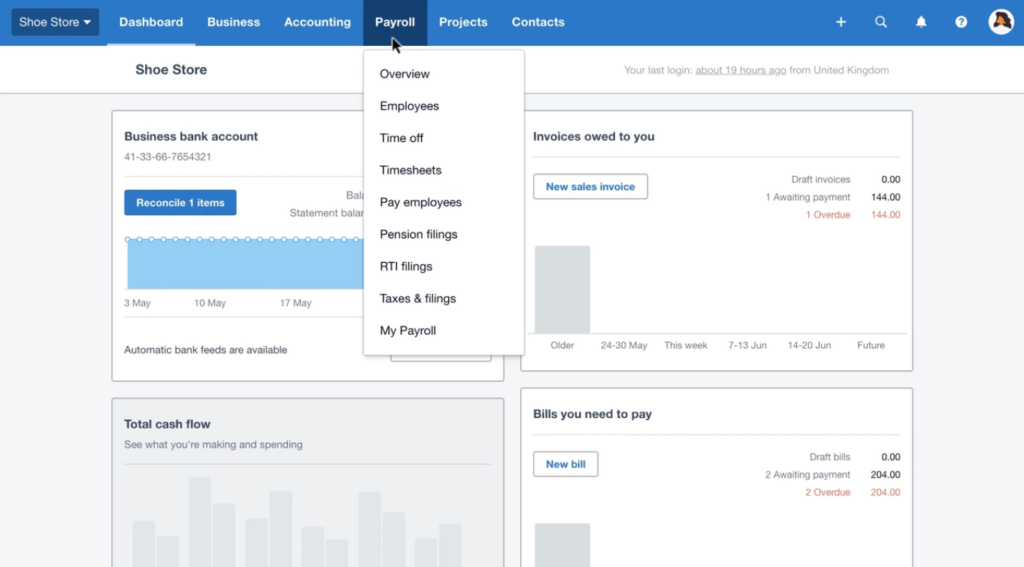

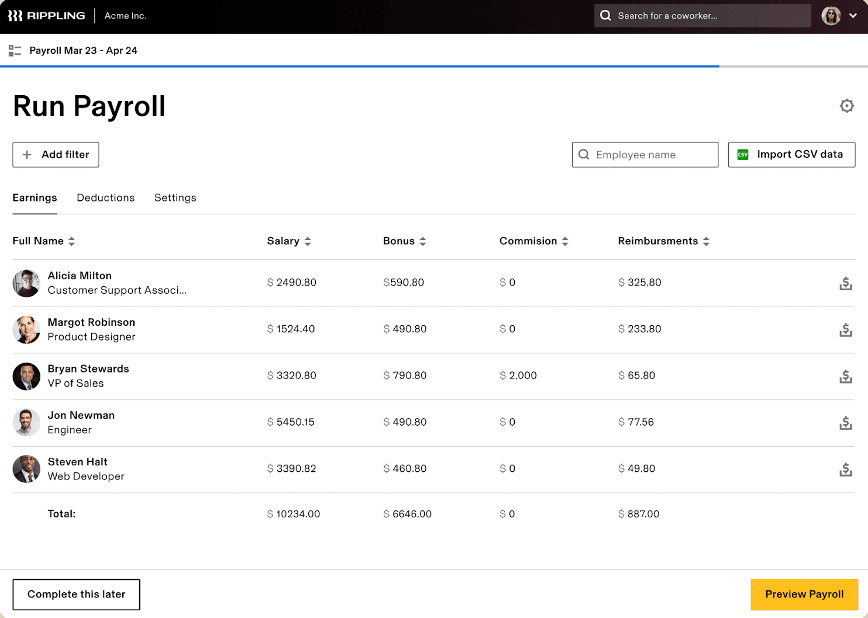

3. Rippling

Rippling is a unified workforce management platform that integrates HR, IT, and finance functions, enabling businesses to manage employee data, payroll, benefits, and device management from a single interface.

Key Features

- Payroll Processing: Automates payroll with accurate tax filings and compliance support.

- Benefits Administration: Manages employee benefits, including enrollment and updates.

- Time and Attendance Tracking: Monitors employee hours to ensure accurate payroll.

- Device Management: Oversees company devices, ensuring security and compliance.

- Integration: Connects with over 600 tools to streamline workflows.

Pricing

Rippling’s pricing starts at $8 per user per month, with additional costs for specific modules. Exact pricing varies based on selected features and company size.

Pros

- Comprehensive platform that integrates HR, IT, and finance functions.

- User-friendly interface enhancing accessibility.

- Scalable solutions accommodating business growth.

- Extensive app integrations that streamline workflows.

- Automated compliance features which reduce regulatory risks.

- Efficient device management ensuring security.

Cons

- Some users report limited customer support responsiveness.

- Initial setup can be complex for new users.

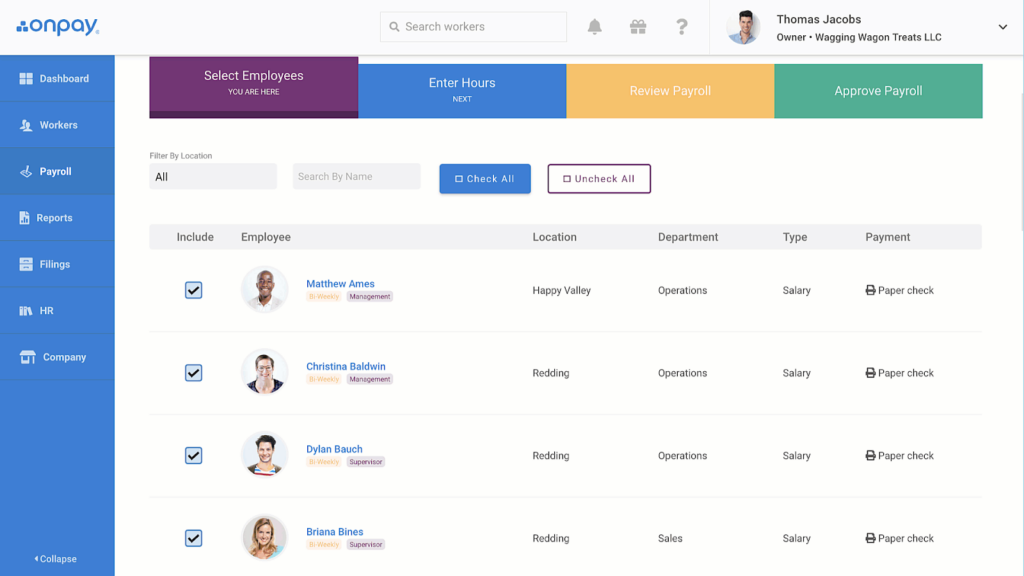

4. OnPay

OnPay is a cloud-based payroll and HR solution designed for small to mid-sized businesses, offering comprehensive features to streamline payroll processing, tax filings, and human resources management.

Key Features

- Full-Service Payroll: Automates payroll processing with unlimited monthly pay runs and handles federal, state, and local tax filings.

- Employee Self-Service: Allows employees to access pay stubs, tax forms, and personal information through a secure portal.

- Benefits Administration: Manages employee benefits, including health insurance and retirement plans, with integrated enrollment and compliance support.

- Time Off Management: Tracks employee paid time off (PTO) requests and approvals, ensuring accurate accruals and record-keeping.

- Integrations: Seamlessly connects with accounting software like QuickBooks and Xero, enhancing workflow efficiency.

Pricing

OnPay offers a straightforward pricing model at $40 per month base fee plus $6 per employee. This includes all features without additional fees, providing cost-effective payroll and HR services.

Pros

- User-friendly interface that simplifies payroll tasks.

- Responsive customer support assisting with setup and issues.

- Unlimited pay runs without extra charges.

- Comprehensive tax filing which reduces compliance risks.

- Employee portal enhancing self-service capabilities.

Cons

- Lacks native time-tracking features, which requires third-party integration.

- Some users report limited mobile app functionality.

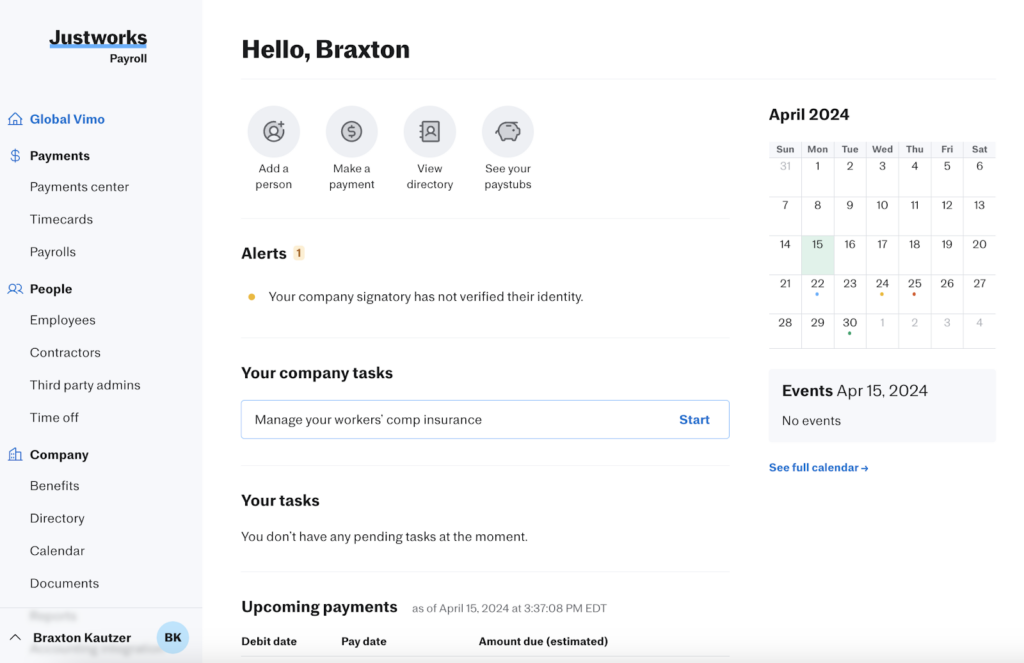

5. Justworks

Justworks is a Professional Employer Organization (PEO) that simplifies payroll, benefits, HR, and compliance for small to mid-sized businesses. It offers a unified platform to manage various administrative tasks efficiently.

Key Features

- Payroll Processing: Automates payroll for employees and contractors, including tax filings and direct deposits.

- Benefits Administration: Provides access to health insurance, 401(k) plans, and other employee benefits.

- Compliance Support: Assists with adherence to federal, state, and local employment laws.

- Time Off Management: Tracks employee paid time off (PTO) and approvals.

- HR Tools: Offers resources for employee onboarding, document storage, and performance management.

Pricing

Justworks offers transparent pricing with the following plans:

- Payroll plan at $8 per month per employee + $50 per month base fee

- PEO Basic plan at $59 per month per employee

- PEO Plus plan at $109 per month per employee

- EOR plan at $599 per month per employee

Pros

- Comprehensive PEO services that streamline HR functions.

- Transparent pricing structure with no hidden fees.

- Access to large-group health insurance plans.

- 24/7 customer support via multiple channels.

- User-friendly interface simplifying administrative tasks.

- Automated tax filings which reduce compliance risks.

Cons

- Time tracking requires an additional fee.

- Limited customization options for reports.

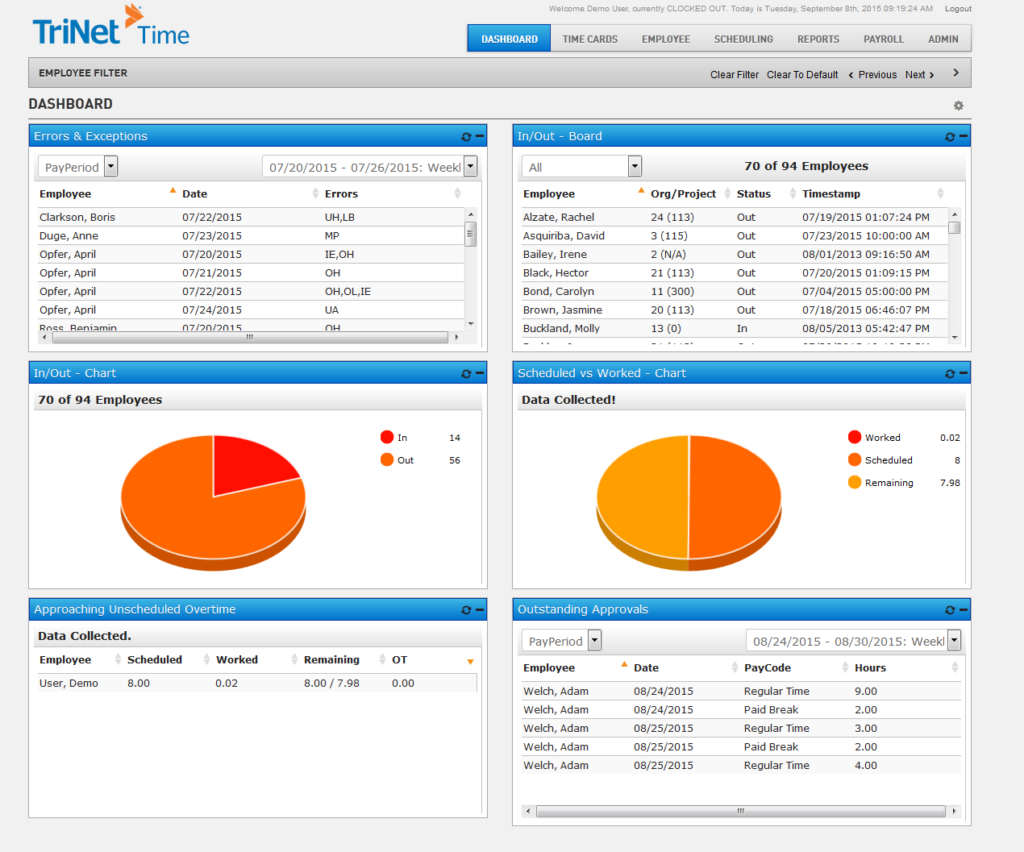

6. TriNet

TriNet is a comprehensive HR solutions provider offering PEO services, as well as a cloud-based HR software tailored for small to mid-sized businesses. It streamlines payroll, benefits, compliance, and risk mitigation, allowing companies to focus on core operations.

Key Features

- Payroll Processing: Automates payroll tasks, including tax calculations and direct deposits.

- Benefits Administration: Provides access to health insurance, retirement plans, and other employee benefits.

- Compliance Support: Assists with adherence to federal, state, and local employment laws.

- Risk Mitigation: Offers guidance on reducing employment-related risks.

- Employee Self-Service Portal: Allows employees to access pay stubs, tax documents, and benefits information.

Pricing

TriNet’s pricing varies based on company size, industry, and selected services.

For its HR Platform, plans range from $10 to $33 per employee per month. Payroll processing is included only in the high-end Zen plan, while the Essentials and Growth plans offer payroll as an add-on.

Pros

- Comprehensive HR services that streamline administrative tasks.

- Access to large-group benefits enhancing employee offerings.

- Scalable solutions accommodating business growth.

- Industry-specific expertise that provides tailored support.

- User-friendly employee self-service portal which improves accessibility.

- Automated compliance features reducing regulatory risks.

Cons

- Some users report limited customer support responsiveness.

- Payroll processing included only in the high-end Zen plan.

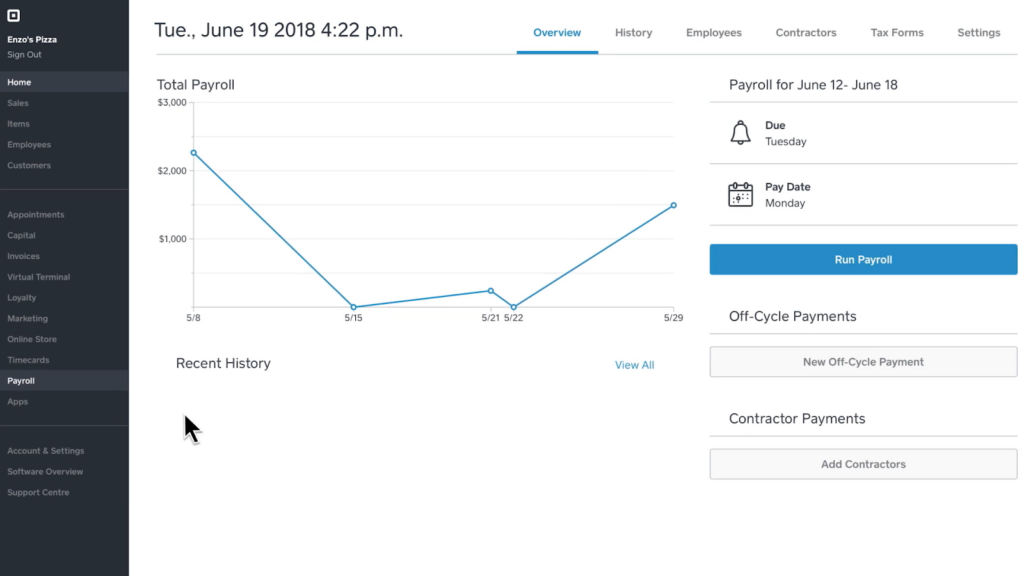

7. Square Payroll

Square Payroll is a user-friendly payroll service designed for small to mid-sized businesses. The tool seamlessly integrates with Square’s ecosystem to simplify employee and contractor payments, tax filings, and benefits administration.

Key Features

- Full-Service Payroll: Automates payroll processing, including tax calculations and filings.

- Employee Benefits Management: Offers health insurance, retirement plans, and workers’ compensation options.

- Time Tracking Integration: Syncs with Square’s timecards for accurate wage calculations.

- Flexible Payment Options: Supports direct deposit, manual checks, and payments via Cash App.

- Employee Self-Service Portal: Allows employees to access pay stubs and tax documents online.

Pricing

Square Payroll offers two plans: a Full-service plan at $35 per month plus $6 per person paid, and a Contractors-Only plan at $6 per contractor per month.

Pros

- Seamless integration with Square POS that enhances operational efficiency.

- Automated tax filings reducing administrative burden.

- Affordable contractor-only plan benefits small businesses.

- User-friendly interface simplifying payroll management.

- Flexible payment options, including instant payments via Cash App.

- No long-term contracts; services can be paused as needed.

Cons

- Limited reporting capabilities may hinder detailed analysis.

- Customer support primarily via email, which lacks immediate assistance.

8. Patriot Software

Patriot Software offers cloud-based payroll solutions tailored for small businesses. It aims to simplify payroll processing, tax filings, and employee management with an intuitive interface.

Key Features

- Unlimited Payroll Runs: Process payroll as often as needed without extra charges.

- Tax Filing Services: Calculates, withholds, and remits federal, state, and local taxes.

- Employee Portal: Provides employees with access to pay stubs and tax documents.

- Direct Deposit: Facilitates timely and secure employee payments.

- Time and Attendance Integration: Offers add-on for tracking employee hours.

Pricing

Patriot offers two payroll plans at half the price for the first 3 months:

- Basic Payroll at $8.50 per month plus $2 per employee (usually $17 per month plus $4 per employee).

- Full Service Payroll at $18.50 per month plus $2.50 per employee (usually $37 per month plus $5 per employee).

They also offer add-ons with the payroll plans, such as Time & Attendance and HR Software, each at $3 per month plus $1 per employee ($6 per month plus $2 per employee without discount).

Pros

- Unlimited payroll that runs without additional fees.

- User-friendly interface enhancing usability.

- Responsive U.S.-based customer support.

- Seamless integration with Patriot’s accounting software.

- Tax filing accuracy guarantee with Full Service plan.

Cons

- Limited third-party integrations may restrict flexibility.

- No mobile app available for on-the-go access.

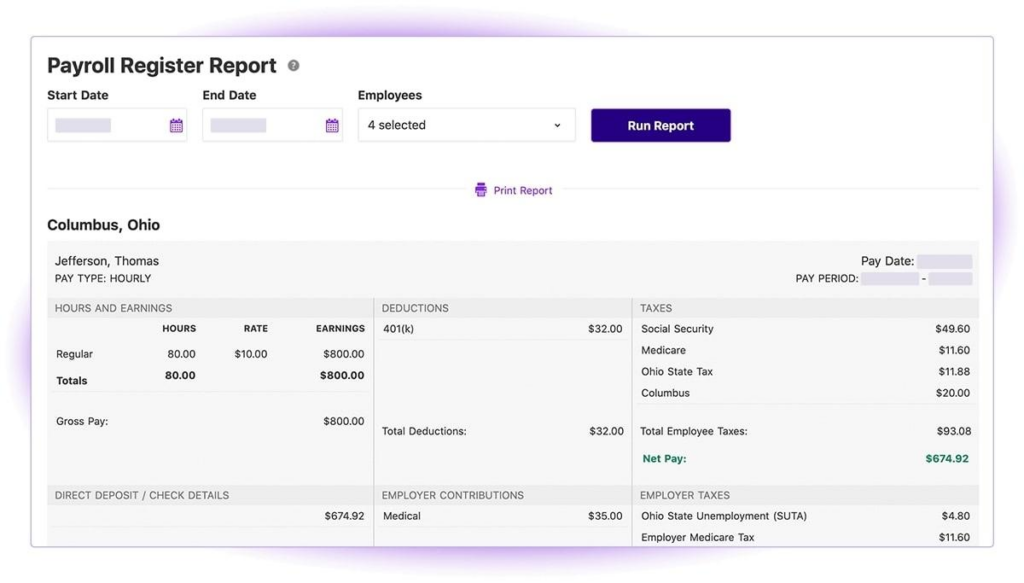

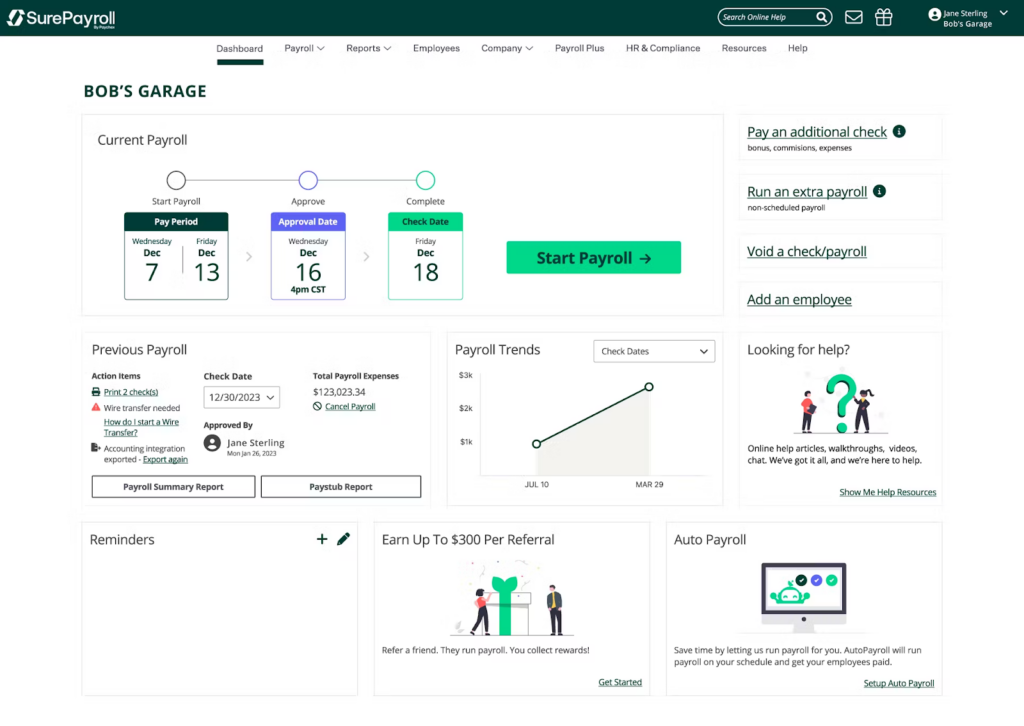

9. SurePayroll

SurePayroll is an online payroll service tailored for small businesses. The platform offers automated payroll processing, tax filing, and compliance management to simplify employee payments and administrative tasks.

Key Features

- Automated Payroll: Processes payroll with automatic tax calculations and filings.

- Employee Self-Service: Provides employees access to pay stubs and tax documents online.

- Benefits Administration: Offers 401(k) plans, health insurance, and workers’ compensation options.

- Time Clock Integration: Supports integration with various time-tracking systems for accurate payroll.

- Mobile Accessibility: Allows payroll processing and management via mobile app.

Pricing

SurePayroll’s pricing for small businesses start at

- $20 per month plus $4 per employee without any tax filing.

- $29 per month plus $7 per employee, with full-service payroll services.

They also offer a Household Plan featuring full payroll services at $39 per month including one employee, with each additional employee being charged an extra $10. You get the first 6 months for free.

Pros

- User-friendly interface that simplifies payroll tasks.

- Unlimited payroll that runs without extra charges.

- Mobile app enhancing accessibility for payroll processing.

- Automatic tax calculations and filings ensuring compliance.

- Six-month free trial that offers risk-free evaluation.

- Integration with accounting software that streamlines financial management.

Cons

- Limited HR tools compared to competitors.

- Additional fees for year-end tax services.

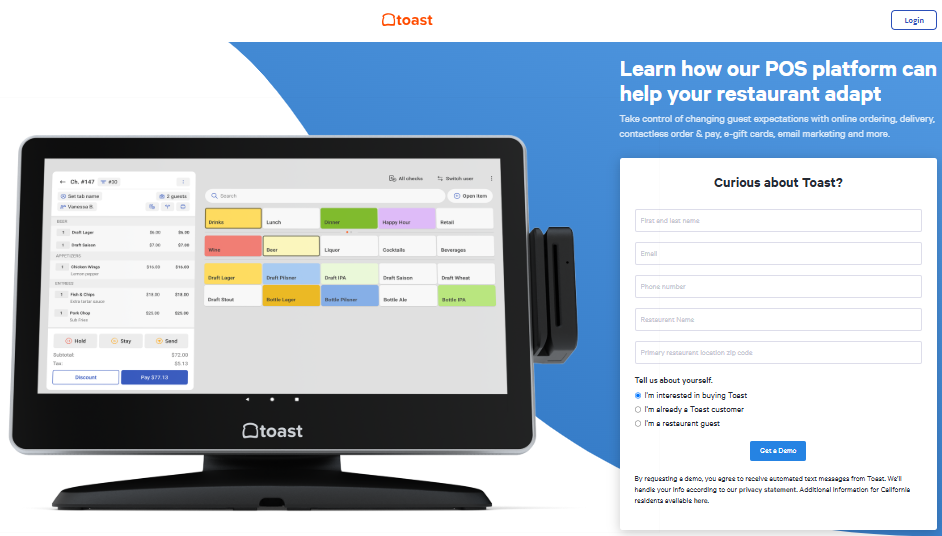

10. Toast Payroll

Toast Payroll is a cloud-based payroll and team management platform specifically designed for the restaurant industry. It integrates seamlessly with Toast’s point-of-sale (POS) system, streamlining payroll processing, employee scheduling, and compliance management to enhance operational efficiency.

Key Features

- Automated Payroll Processing: Calculates wages, taxes, and deductions, ensuring accurate and timely employee payments.

- Tip Management: Automates tip distribution, simplifying compliance with tip pooling regulations.

- Employee Scheduling: Facilitates shift planning and management, reducing scheduling conflicts.

- Time Tracking Integration: Syncs employee hours directly from the POS system for precise payroll calculations.

- Compliance Tools: Assists with adherence to labor laws and tax regulations, minimizing compliance risks.

Pricing

Toast Payroll’s pricing starts at $110 per month, with an additional $4 per employee. Additional services, such as tip management and scheduling, may incur extra fees.

Pros

- Seamless integration with Toast POS enhances data accuracy.

- Designed specifically for restaurants, addressing industry-specific needs.

- Automated tax calculations and filings reduce administrative workload.

- User-friendly interface simplifies payroll and scheduling tasks.

- Comprehensive compliance support ensures adherence to labor laws.

- Robust reporting tools provide valuable business insights.

Cons

- Higher cost compared to some competitors, which may impact budget-conscious businesses.

- Customer support responsiveness has been reported as inconsistent by some users.

Choose the Best Gusto Alternative— Checkwriters

Exploring Gusto alternatives reveals a variety of payroll and HR tools, each designed to meet unique business needs. Whether you prioritize affordability, advanced features, or scalability, the right solution is within reach. For a customer-centric platform, consider Checkwriters.

At Checkwriters, we offer a balanced, all-in-one payroll and HR solution. From automated payroll processing to robust compliance tools and a mobile app, we streamline the employee lifecycle while providing exceptional support tailored to your organization’s goals.Contact us at Checkwriters today and elevate your HR and payroll experience.