Quick Summary

Managing payroll in the restaurant industry comes with unique challenges such as handling tips, varied schedules, and complex compliance requirements. This article highlights the top restaurant payroll software solutions designed to simplify these tasks, save time, and enhance accuracy. From tools offering POS integration to those specializing in tip reporting, we’ve covered the best options available—including Checkwriters. Explore this list to find the perfect payroll tool that meets your business needs and helps streamline your operations.

Looking for the Best Payroll Software for Your Restaurant?

Managing a restaurant means juggling culinary skills with operational smarts. Whether you run a cozy café or a bustling global eatery, having smooth payroll processing is key. The right restaurant payroll services take the headache out of payroll management, freeing you up to create unforgettable dining experiences. Let payroll be the least of your worries so you can focus on what you love most—delighting your guests.

In this listicle, we break down the top payroll tools that provide great value for the restaurant industry, including Checkwriters, which offers a robust solution tailored to meet your unique needs.

From user-friendly interfaces to robust features tailored to the food industry’s unique challenges, these payroll providers are ready to revolutionize how restaurants of various sizes manage their payrolls.

Why Listen to Us?

At Checkwriters, we have extensive experience assisting restaurants in optimizing their payroll and HR operations. Our partnership with hospitality group The Log Cabin and Delaney House helped enhance their payroll accuracy and efficiency so they could continue providing a world-class guest experience.

And for franchise owners or groups with multiple locations, our partnership with Dunkin’ Donuts franchisors The Carvalho Group helped streamline the payroll and onboarding processes , allowing them to focus more on delivering quality service and coffee at their locations in metro Boston.

By addressing industry-specific challenges, we’ve enabled our clients to reduce administrative burdens and maintain consistent payroll accuracy, empowering them to concentrate on growth and customer satisfaction.

What is Restaurant Payroll Software?

Restaurant payroll software is a specialized tool that streamlines payroll processing for the food service industry. It manages wages, tips, overtime, and varying schedules, ensuring compliance with labor laws while reducing errors.

These solutions simplify time tracking, handle complex pay structures, and automate tax calculations. Restaurant payroll software also integrates with POS systems, making it easier to track hours and tips.

By automating payroll tasks, restaurant payroll software helps owners and managers save time, maintain accuracy, and stay compliant.

5 Best Restaurant Payroll Software Tools

- Checkwriters

- Gusto

- Square Payroll

- ADP Run

- OnPay

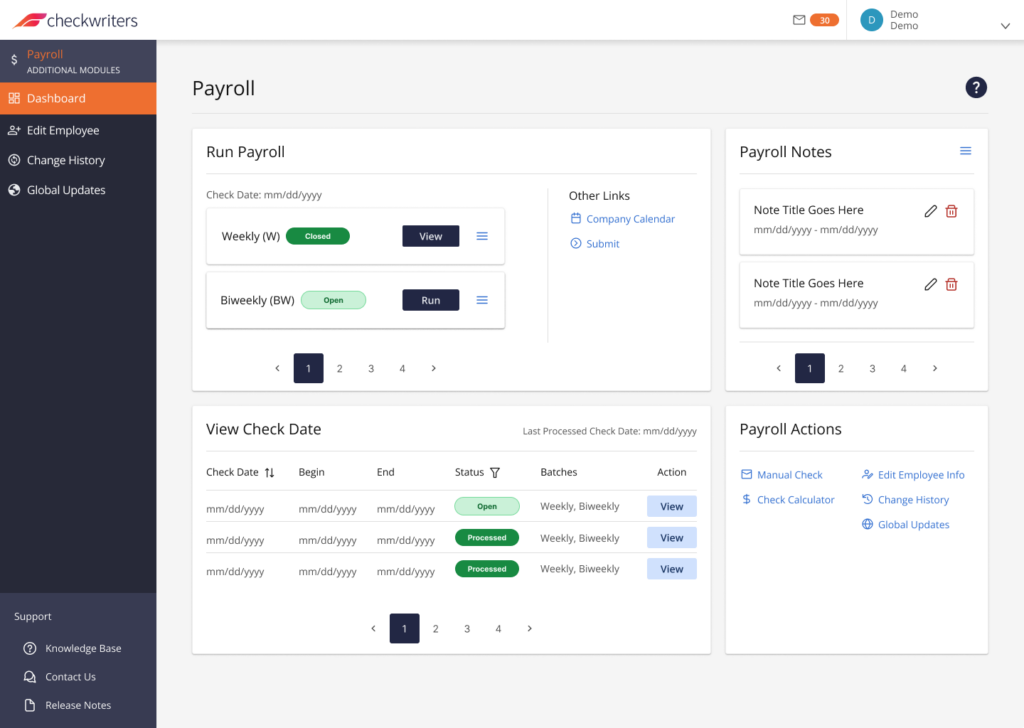

1. Checkwriters

Checkwriters is an all-in-one payroll and human resources platform that automates payroll functions and supports additional HR tasks such as onboarding, attendance, and more. Designed for flexibility, our solution streamlines your restaurant’s payroll processing, handling complex tip calculations, variable schedules, and compliance.

Checkwriters provides a reliable experience for restaurant owners and managers seeking efficiency, while ensuring crucial tax and compliance support from our team.

Key Features

- Payroll Automation: Handles complex payroll tasks, including tip and overtime calculations, to save time and reduce errors.

- Compliance Management: Provides tools for managing labor law compliance, helping to avoid penalties.

- POS Imports: Custom imports for popular POS systems for accurate time and tip tracking.

- Attendance Tracking: Seamlessly keep track of employee hours and attendance with automated reports that sync with payroll.

- Onboarding: Automatically onboard new hires, from paperwork completion to training resources, all within one platform.

- Mobile Access: Managers and employees can easily access payroll and HR services (such as viewing pay stubs and managing time-off requests) on the go.

- Custom Reporting: Includes a robust reporting tool for creating customized payroll and HR reports.

Pricing

Request a Checkwriters demo for more details and a custom quote.

Pros

- Reliable customer-centric support, with dedicated payroll assistance and tax filing

- Custom imports for your POS system

- Comprehensive compliance support

Cons

- Onboarding requires additional setup time, however, you will receive one-on-one support for this and the Checkwriters team handles the heavy lifting with setting up your account

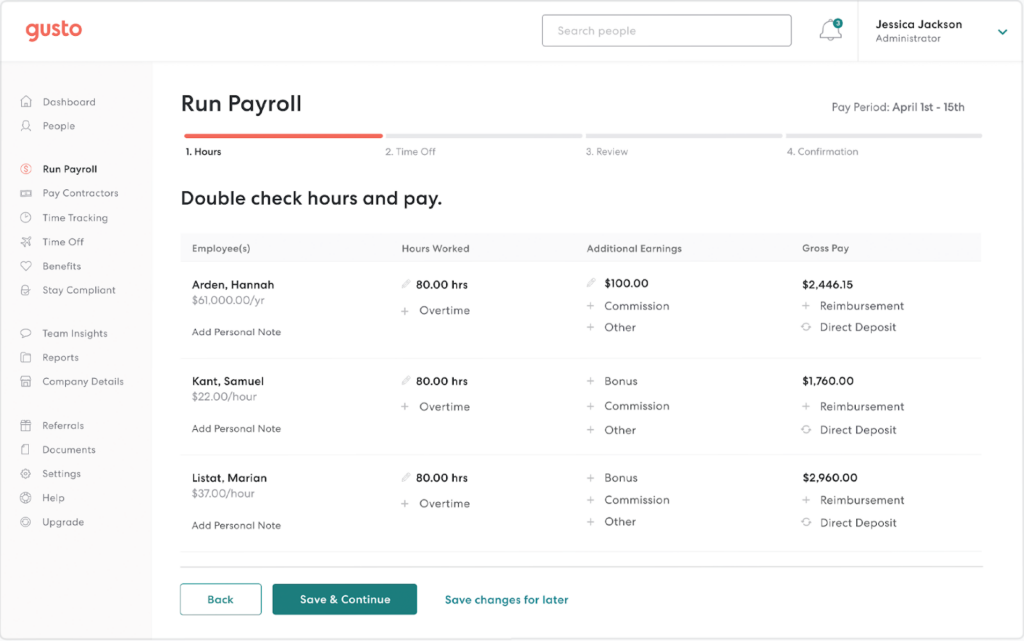

2. Gusto

Gusto is a cloud-based payroll and HR platform designed to simplify payroll processing for small to medium-sized businesses, including restaurants.

It automates payroll tasks, manages employee benefits, and ensures compliance with labor laws, making it a comprehensive solution for restaurant payroll needs.

Key Features

- Automated Payroll Processing: Calculates and files payroll taxes automatically, reducing manual effort and errors.

- Time Tracking Integration: Syncs with time-tracking tools to accurately record employee hours and manage overtime.

- Tip Reporting: Handles tip calculations and reporting, ensuring compliance with IRS requirements.

- Employee Self-Service: Provides employees with access to their pay stubs, tax documents, and personal information through a user-friendly portal.

- Compliance Assistance: Keeps up-to-date with federal, state, and local labor laws to help maintain compliance.

Pricing

Gusto offers tiered pricing plans:

- Simple: $40/month base fee plus $6 per person.

- Plus: $80/month base fee plus $12 per person.

- Premium: Custom pricing for advanced features and dedicated support.

Each plan includes full-service payroll with varying levels of HR tools and support.

Pros

- User-friendly interface

- Comprehensive payroll and HR features

- Scalable pricing plans

Cons

- Limited customization options

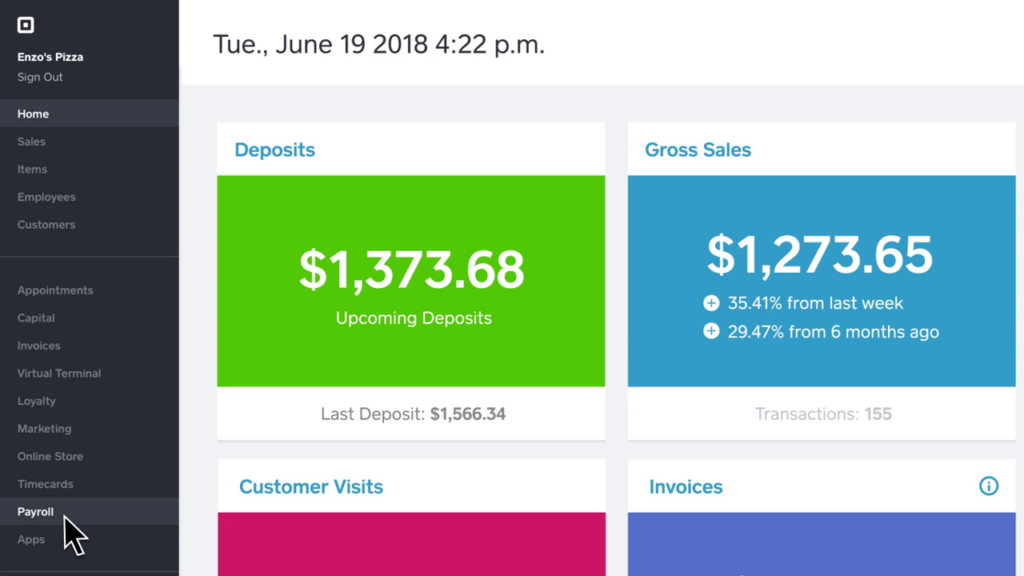

3. Square Payroll

Square Payroll is a user-friendly payroll solution designed for small businesses.

It offers seamless integration with Square’s point-of-sale system, simplifying payroll processing by automatically importing timecards and managing tips. This integration ensures accurate and efficient payroll management tailored to the unique needs of the restaurant industry.

Key Features

- Automatic Tax Filings: Calculates and files federal and state payroll taxes, reducing administrative burden.

- Tip Management: Handles tip reporting and distribution, ensuring compliance with labor laws.

- Timecard Importing: Integrates with Square POS to import employee hours directly into payroll.

- Employee Self-Service: Provides a portal for employees to access pay stubs and tax documents.

- Flexible Payment Options: Offers direct deposit and manual check options to accommodate various payment preferences.

Pricing

Square Payroll offers two pricing plans:

- Employees and Contractors: $35 monthly subscription fee plus $6 per person paid.

- Contractors Only: No subscription fee; $6 per contractor paid.

Both plans include full-service payroll features, with the Employees and Contractors plan providing additional employee management tools.

Pros

- Transparent, straightforward pricing

- Automated tax filings

Cons

- Limited advanced HR features

- Primarily suited for very small businesses, larger restaurants or groups with multiple locations will struggle

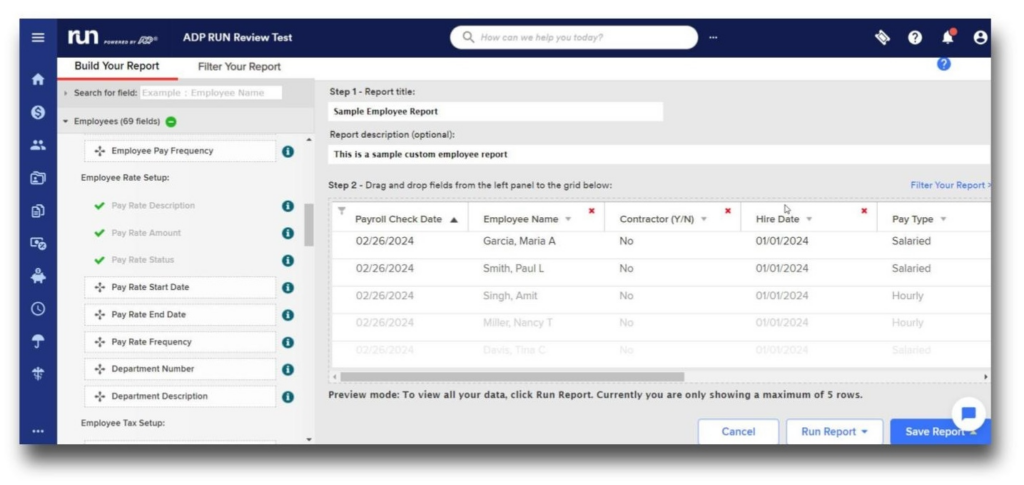

4. ADP Run

ADP Run is a comprehensive payroll and HR solution tailored for small businesses, including restaurants. It offers automated payroll processing, tax filing, and compliance support, streamlining HR tasks to allow restaurant owners to focus on operations.

ADP Run’s scalability makes it suitable for restaurants of various sizes.

Key Features

- Automated Payroll Processing: Calculates wages, including tips and overtime, and processes payroll efficiently.

- Tax Filing Services: Manages federal, state, and local payroll tax filings, ensuring compliance and accuracy.

- Time and Attendance Integration: Syncs with time-tracking systems to accurately record employee hours.

- Employee Self-Service Portal: Allows staff to access pay statements, tax forms, and personal information online.

- Compliance Updates: Provides alerts and updates on labor laws and regulations to help maintain compliance.

Pricing

ADP Run offers customized pricing based on business size and specific needs. Prospective users should contact ADP directly for a personalized quote.

Pros

- Comprehensive payroll and HR features

- Scalable solutions for growing businesses

- Strong compliance support

Cons

- Features and software can be overwhelming

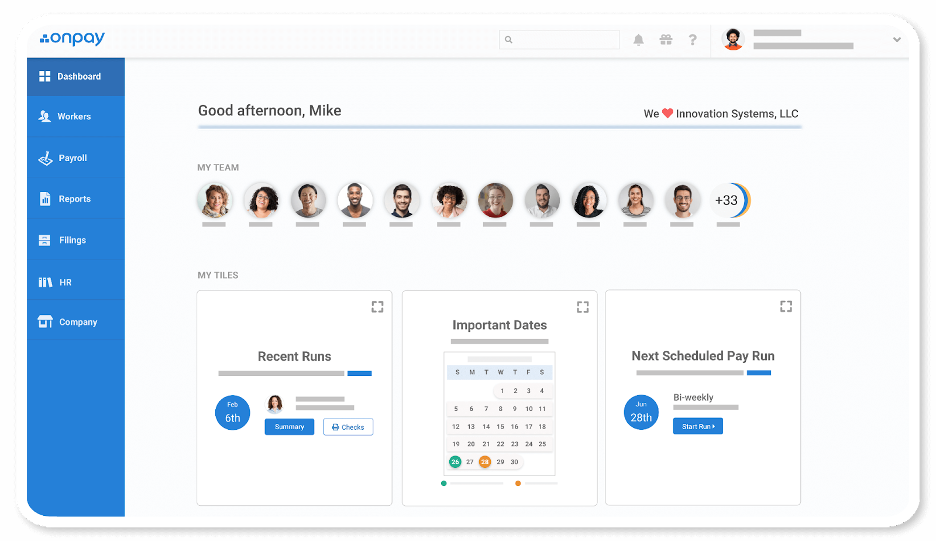

5. OnPay

OnPay is a cloud-based payroll and HR solution designed to simplify payroll processing for small to medium-sized businesses.

It automates payroll tasks, manages employee benefits, and ensures compliance with labor laws, making it a comprehensive solution for restaurant payroll needs.

Key Features

- Automated Payroll Processing: Calculates and files payroll taxes automatically, reducing manual effort and errors.

- Time Tracking Integration: Syncs with time-tracking tools to accurately record employee hours and manage overtime.

- Tip Reporting: Handles tip calculations and reporting, ensuring compliance with IRS requirements.

- Employee Self-Service: Provides employees with access to their pay stubs, tax documents, and personal information through a user-friendly portal.

- Compliance Assistance: Keeps up-to-date with federal, state, and local labor laws to help maintain compliance.

Pricing

OnPay offers a straightforward pricing model: a $40 monthly base fee plus $6 per employee. This includes full-service payroll and HR features, with no hidden fees.

Pros

- User-friendly interface

- Comprehensive payroll and HR features

- Transparent, affordable pricing

Cons

- Limited advanced HR features

- No automatic payroll option

Why is Restaurant Payroll Software Important?

Effective payroll management is critical in the restaurant industry, where variable hours, tips, and compliance challenges create complexity. Here’s why restaurant payroll software is essential:

- Simplifies Payroll Processing: Automates complex payroll calculations, including tips and overtime, reducing manual work and errors.

- Ensures Compliance: Helps restaurants stay compliant with labor laws and tax regulations, avoiding costly fines.

- Integrates Seamlessly with POS Systems: Syncs employee hours and tip data directly from POS, streamlining operations.

- Enhances Employee Satisfaction: Provides timely, accurate pay and easy access to payroll information, boosting staff morale.

- Saves Time and Resources: Automates repetitive tasks, freeing up managers to focus on service and operations.

Find the Right Payroll Solution for Your Restaurant

Choosing the right payroll software is critical for managing restaurant staff, handling tips, and ensuring compliance. Each tool on our list offers valuable features, but finding the best fit depends on your specific needs. For a comprehensive solution, consider Checkwriters.

Checkwriters excels at simplifying payroll and HR processes for restaurants. With robust automation, custom POS imports, and strong compliance support, it’s designed to meet the unique demands of the restaurant industry while saving time and reducing errors.

With Checkwriters, you’re in safe hands. Our customer-centric approach means we prioritize what matters most to you–seamless wage calculations, accurate tax filing, compliance updates, and high-quality customer service. When it comes to payroll automation, Checkwriters is a solution you can rely on. Ready to streamline your restaurant’s payroll with Checkwriters? Contact our team today for a demo!