There are several 2024 updates regarding the Massachusetts Paid Family and Medical Leave Law. These include new “top-off” rules (which allows employees on PFML to supplement their weekly PFML benefit with their accrued PTO); employee and employer contribution rate increases; and an increase to the maximum weekly benefit.

What are the Massachusetts PFML “Top-Off” Rules?

The Massachusetts Department of Family and Medical Leave (DFML) has announced the enactment of new legislation providing for employees to “top-off” or supplement paid family and medical leave benefits with available or accrued employer-provided paid time off (“PTO”) such as vacation, sick or personal time up to the employee’s individual average weekly wage (“IAWW”). The ability to “top-off” or supplement an employee’s PFML benefits applies to all claims filed after November 1, 2023.

Additional guidance is expected from the DFML in the coming months. In the interim, employers can consult a series of FAQS published by the Department on its website.

How is an Employee’s Individual Average Weekly Wage (IAWW) Calculated?

An employee’s IAWW is calculated from the amount an employee earned in the last four completed calendar quarters before the start of the employee’s benefit year. The IAWW is the average amount the employee earned per week in the employee’s two highest quarters, or if the employee worked two or less quarters, the one quarter where the employee earned the most money.

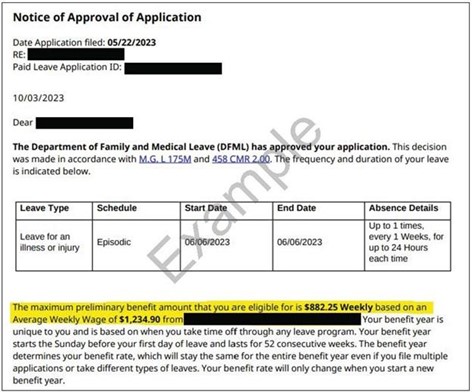

This figure will be calculated by the DFML and provided to Leave Administrators in the employee’s leave approval notice, along with the employee’s PFML benefit amount. Please see a sample approval letter where this information can be located provided by the DFML:

Employers Must Have a “Leave Administrator” Registered with the DFML

It is imperative that all employers have a Leave Administrator registered and on file with the DFML. If an employer does not have a Leave Administrator then it cannot access this information. The DFML reminds employers that “[b]eing actively engaged in managing your employees’ leaves is essential to being compliant with PFML’s statutory and regulatory requirements and ensuring that your employees get the amount and duration of leave for which they are eligible.”

Employers should take this opportunity to verify that they have a current and correct Leave Administrator on file with the DFML. Employers may find information on managing their employer account including granting access to a Leave Administrator on the DFML website.

Leave Administrators may calculate an employee’s eligible “top-off” amount by subtracting the amount of the PFML benefits from the employee’s IAWW. This is the maximum amount an employee may use to supplement their PFML benefit. Employers are responsible for ensuring that employees do not exceed their IAWW with a combination of available or accrued PTO and their PFML benefit.

How Does PTO Affect an Employee’s Eligibility for Benefits?

Utilizing PTO will not affect an employee’s eligibility for benefits, nor will it affect the amount of benefits to which an employee is entitled. Employers are not required to report the PTO “top-off” to the DFML. While employers must permit employees to utilize available or accrued PTO to supplement their PFML benefits during eligible periods of leave if they choose, employers may not require employees to do so.

For employees with claims filed prior to November 1, 2023, they are not eligible to utilize the new “top-off” guidance. Employees with applications filed prior to November 1, 2023, may continue to utilize PTO during the seven (7) day PFML waiting period only. For employees who file claims on or after November 1, 2023 for retroactive leave that began before November 1, 2023, so long as the application is filed on or after November 1, 2023, these employees are eligible to use PTO to “top-off” their PFML benefits during eligible periods of leave.

Employers should inform their employees of the option for them to use available or accrued PTO to supplement their PFML benefit while they are on leave up to their IAWW. For employers who have a private plan exemption from the DFML, private plans are also required to allow for “top-off” or supplementation of employee PFML benefits.

What are the Massachusetts PFML Contribution Rates for 2024?

The DFML has released its FY 2023 Annual Report which is available on the Commonwealth DFML website. Coinciding with this release, the DFML also examines and evaluates contribution rates for the coming year. While in years past the contribution rate has decreased, effective January 1, 2024, the combined contribution rate for employees and employers will increase from 0.63% of eligible wages to 0.88% of eligible wages.

For those employers with less than twenty-five (25) employees who are not required to contribute to the employer share of the medical contribution, the employee contribution rate will increase from 0.318% to 0.416%.

Employers with twenty-five (25) or more employees are required to contribute to the employer’s share of the medical leave contribution which represents 60% of the total contribution (0.42% of eligible wages) with the other 40% of the medical contribution (0.28% of eligible wages) being withheld from a covered individual’s wages. Employers may contribute to the family leave contribution for their employees, or may withhold the entire amount (0.18%) from their employees’ eligible wages.

Individual contributions are capped at the Social Security taxable wage base which will increase to $168,600.00 for 2024.

Increases to the contribution rate can be attributed to increased usage of the program from FY 2022 to FY 2023. According to the FY2023 Annual Report for the Massachusetts Paid Family and Medical Leave program, there was an 27.39% increase in approved applications over FY22, and a 37% increase in total benefits paid between FY22 and FY23, with the DFML paying out a total of $832,556,023.75 in family and medical leave benefits in FY23 (July 1, 2022-June 20, 2023).

What is the Massachusetts PFML Maximum Weekly Benefit for 2024?

For 2023, the state average weekly wage is $1,765.34 and the maximum weekly benefit rate is $1,129.82. For 2024, the state average weekly wage is $1,796.72 and the maximum weekly benefit rate will be $1,149.90. Employers can consult the DFML website for additional information and guidance on weekly benefit rate calculation.

Disclaimer: The information contained herein is not intended to be construed as legal advice, nor should it be relied on as such. Employers should closely monitor the rules and regulations specific to their jurisdiction(s) and should seek advice from counsel relative to their rights and responsibilities.