Achieve Accuracy and Confidence in your Payroll Software

Payroll Software, Payroll Tax Services, and Employee Self-Service Apps that simplify your payroll responsibilities

It makes it pretty simple to do my job as a Manager.

Charles, St. Marks School

1

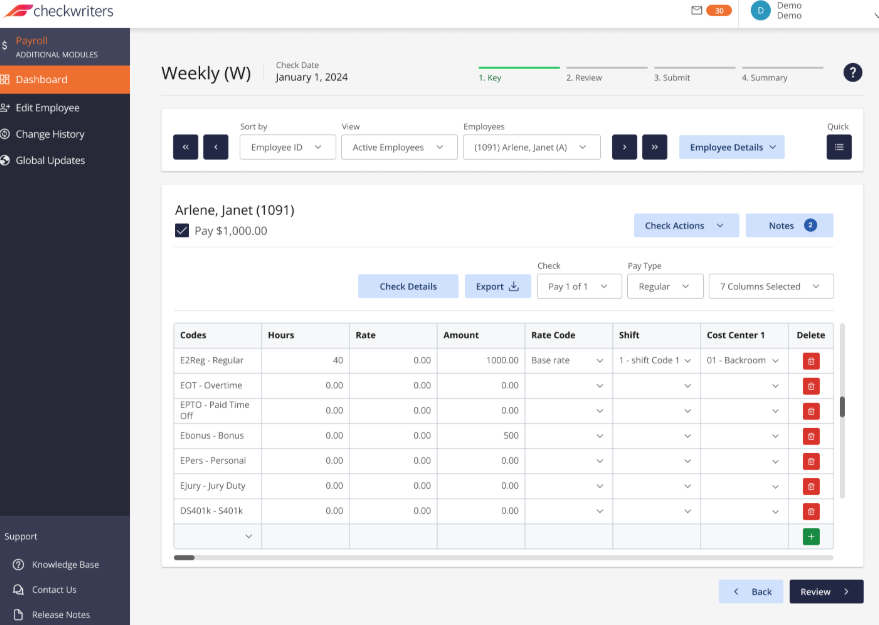

Flexible Input Options

Individualized check previews

Customize check previews to ensure everything looks just right before finalizing payroll.

Import from attendance

Easily import attendance data for streamlined payroll processing

Fly through payroll using quick-entry

Save time by using quick-entry features to process payroll efficiently.

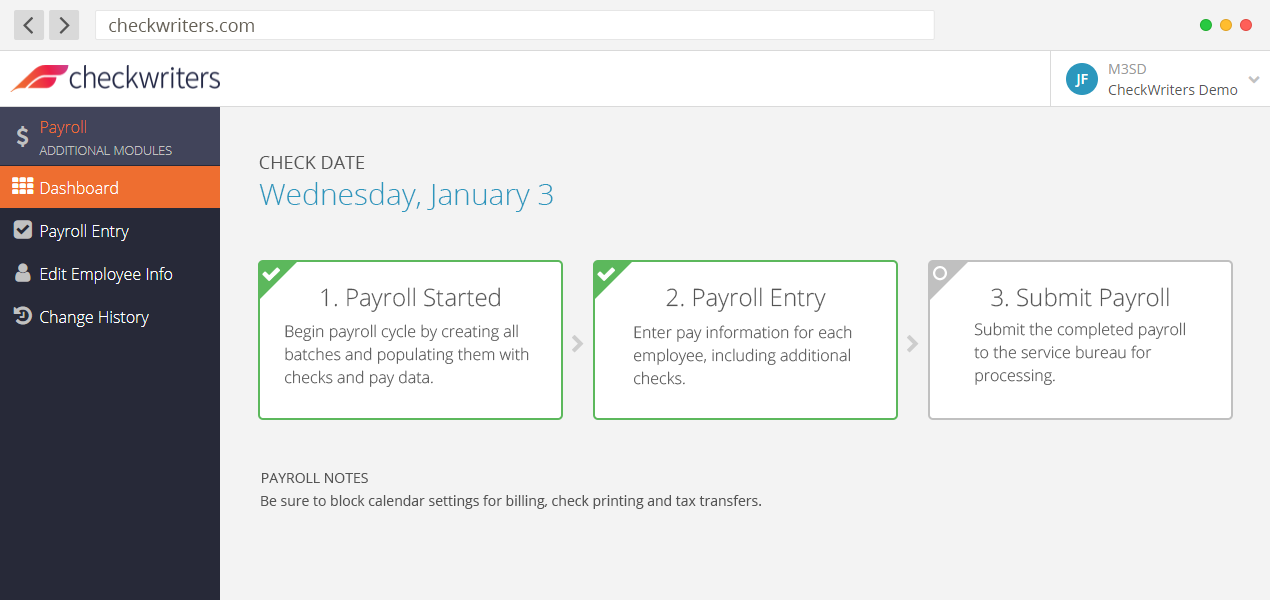

2

Pre-Process Preview

Review payroll totals

View payroll summaries sorted by employee, department, or company

Individual Paycheck Reviews and Net-to-Gross Calculators

Check each paycheck before processing to ensure accuracy, and use net-to-gross calculators for precise tax calculations.

3

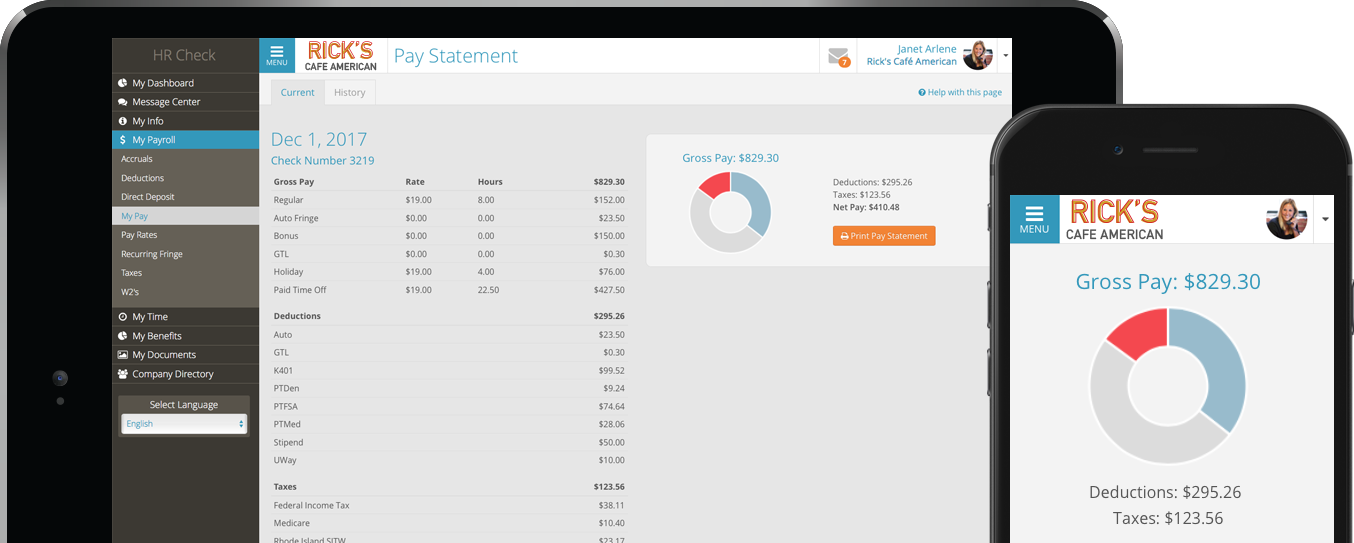

Happy and Engaged Employees

Our mobile app makes your job easier by giving your employees convenient access to their pay data and info on the go

Since Your Workforce is already Mobile – using their smartphones to access news, weather, directions, and their bank accounts – they expect to interact with your company and access their work information from anywhere

4

Taxes Taken Care Of

Our full-service Tax Department files taxes in all 50 states + US territories

Say goodbye to the complexity of filing taxes in multiple states and localities. We take care of it all, monitoring compliance and timely submissions.

Why Choose Our Payroll Software?

- Effortless Compliance: Our payroll software helps you manage compliance with constantly changing federal, state, and local payroll regulations across states

- Time-Saving Features: Designed for efficiency, our payroll software automates complex payroll tasks like tax deductions, pay stub generation, and year-end forms. This significantly speeds up processing, reducing manual work and minimizing human errors.

- Employee Satisfaction: The intuitive mobile app boosts transparency by allowing employees to access pay stubs, tax forms, and other payroll details anytime. This increases trust, reduces questions , and promotes higher employee engagement and morale.

- Seamless Integration: Integrations and reporting with your existing HR and accounting systems helps ensure smooth data flow across departments. It eliminates manual data entry errors, offering a centralized view of HR and financial information.

- Scalable for Growing Businesses: Our payroll software grows with your business, accommodating small businesses or large enterprises. As you expand, adding new employees, departments, or locations is simple, ensuring it adapts to your evolving needs.

- Advanced Security Features: With top-tier encryption and multi-factor authentication, our payroll software protects sensitive employee and financial data. Regular security updates keep your system safe from breaches, ensuring your payroll data is always secure.

- Dedicated Support Team: Our dedicated support team provides personalized assistance for payroll setup, troubleshooting, and tax compliance. Our team will ensure you navigate payroll complexities smoothly and keep everything running efficiently.